Blog

Business Closed But You Still Owe Taxes? Here’s What to Do (And Why the Debt Doesn’t Just Disappear) 📋 📋 Quick Navigation The Harsh Truth

Tax scams are on the rise in 2025, targeting taxpayers with fake IRS calls, phishing emails, and bogus relief offers. Learn how to spot the red flags, understand how the real IRS makes contact, and discover proven ways to resolve tax debt without falling for fraud.

Discover how recent Medicaid and SNAP benefit cuts are impacting millions across five states — from rural hospital closures to families losing vital food assistance. Learn which states are hit hardest and what steps you can take to protect your income and resources.

Starting 2026, Texas introduces a revamped R&D Tax Credit with higher rates, simplified rules, and cash refunds for small businesses. Learn how to qualify.

Should you pay off your mortgage before retirement or carry mortgage debt into your golden years? As more retirees face rising housing costs and longer lifespans, deciding whether to eliminate your monthly mortgage payment can be both a financial and emotional dilemma. With mortgage rates still at historic lows and retirement planning more complex than ever, knowing when (and if) to pay off your mortgage could be the key to long-term peace of mind. Before you tap into savings or rush to zero out your balance, consider how mortgage payoff impacts your cash flow, taxes, investment returns, and retirement flexibility.

Senate changes to Trump’s 2025 tax bill bring major shifts: a delayed “revenge tax,” permanent business deductions, reduced SALT cap, EV credit cuts, and stricter Medicaid rules. IRSProb.com breaks down what it means for investors, business owners, and families—and how to prepare.

If you’re a contractor dealing with IRS debt, you’re not alone. From missed estimates to mounting penalties, tax issues can spiral fast. This guide shows how real pros—like electricians, roofers, and HVAC techs—can resolve IRS problems legally and permanently.

For independent insurance adjusters, tax season can bring more chaos than a storm zone. With 1099 income and unpredictable earnings, IRS debt can build fast. This guide breaks down how adjusters can legally resolve tax problems using payment plans, settlements, or hardship relief—without sacrificing their business.

In today’s challenging financial climate, resolving IRS issues with expert legal guidance is paramount for Texas residents. Our comprehensive guide, “Resolving IRS Issues with a Texas Tax Lawyer: A Practical Guide”, provides a step-by-step approach tailored specifically for those grappling with tax disputes in the Lone Star State. With insights drawn from real-world experience and current legislative trends, this blog post offers invaluable strategies and actionable advice on navigating the complex IRS system. Whether you’re managing back taxes, penalties, or other IRS challenges, our guide emphasizes how a seasoned Texas tax lawyer can help you secure favorable outcomes. From demystifying the tax resolution process to providing tips on selecting the best legal representation, we cover every angle to help you regain financial stability. Dive in to learn the key components of the “tax resolution texas lawyer guide” and transform your tax troubles into manageable, solvable issues with confidence and clarity.

Discover an in-depth exploration into the intricate world of federal tax liens in Texas with our comprehensive guide. This post delves into every aspect of federal tax liens—from understanding the basics and the filing process to navigating legal implications and comparing tax liens with tax deeds. With an unwavering focus on “overview federal tax liens texas,” we provide valuable insights, actionable strategies, and expert advice tailored for property owners, investors, and legal professionals alike. Gain clarity on the complexities of federal tax lien enforcement, learn about your rights, and explore effective ways to manage or resolve liens that threaten your assets. Dive into the nuances of Texas tax law, uncover expert tips from IRS Prob, and empower yourself with the knowledge needed to make informed decisions. Read on to transform your understanding and approach toward federal tax liens in Texas.

Discover the ultimate “avoid IRS penalties texas guide” meticulously crafted for Texas taxpayers. This comprehensive resource delves into the common IRS penalties that Texans encounter, explains the underlying reasons behind these fines, and provides actionable tips to prevent them. From understanding filing deadlines and tax payment strategies to maintaining meticulous records and handling IRS notices, our guide leaves no stone unturned. Whether you’re a first-time filer or a seasoned taxpayer, this guide is packed with practical advice, real-life examples, and expert insights specifically tailored to the Texas tax landscape. Read on to gain the confidence and knowledge needed to navigate complex IRS regulations and safeguard your financial well-being.

Discover the ultimate guide to effective tax consultation Texas techniques designed specifically for Texans dealing with complex tax scenarios. In this comprehensive blog post from IRS Prob, we delve into strategies that blend legal expertise with local insights to optimize your financial outcomes. Learn how to navigate the intricate world of tax regulations, avoid common pitfalls, and leverage professional consultation techniques that ensure compliance and maximize returns. Whether you’re a small business owner or an individual taxpayer in Texas, this guide equips you with actionable advice, detailed analyses, and real-life success stories. Stay informed with expert FAQs and pro tips that solidify your understanding and enhance your approach to tax matters. Read on to transform your consultation strategy and achieve financial success with effective tax consultation Texas techniques.

Discover everything Texas employers need to know about trust fund recovery penalties, a critical area of IRS enforcement that targets unpaid employment taxes. This comprehensive blog post delves into the fundamentals of trust fund penalties, explores how they can significantly impact your business, and provides actionable guidance to keep your company compliant. With detailed sections on common pitfalls, IRS investigations, and legal implications, you’ll learn not only what these penalties are but also practical steps to prevent them. Whether you’re managing payroll, overseeing tax deposits, or involved in high-level decision-making, understanding your responsibilities regarding trust fund penalties in Texas is essential. Read on to empower your business with the insights and strategies necessary to navigate these complex regulations and avoid costly mistakes.

In today’s complex financial landscape, Texas professionals are increasingly turning to expert guidance when facing IRS installment agreements. This blog post provides a comprehensive roadmap for navigating IRS installment agreements with a specific focus on the unique challenges and questions that Texas professionals face. Whether you’re a seasoned business owner or a burgeoning entrepreneur, our in‐depth exploration of expert IRS installment strategies, common pitfalls, actionable steps, and illuminating case studies will empower you to make the most informed decisions. Delve into detailed explanations, insider tips from IRS Prob, and a robust FAQ section designed to address even your most pressing concerns. Continue reading to learn how tailored expertise in “expert IRS installment texas professionals” can transform your approach to managing tax liabilities and securing financial stability.

In the challenging landscape of tax liabilities in Texas, understanding how to file innocent spouse relief is crucial for many taxpayers facing undue financial burden. This comprehensive guide walks you through every step of the process, from grasping the basics of innocent spouse relief to meeting eligibility criteria, gathering the necessary documentation, and avoiding common filing mistakes. Geared specifically for residents of Texas and supported by IRS Prob, this article provides invaluable insights into the detailed process of filing for relief. Whether you find yourself implicated in joint tax issues or need guidance on separating your liabilities from a former spouse’s obligations, our expert advice and proven strategies ensure you are well-equipped to navigate IRS complexities. Read on to uncover step-by-step instructions, learn key tips, and discover essential resources that will empower you to confidently file innocent spouse relief in Texas.

Discover the ins and outs of IRS audit triggers in Texas and learn what every taxpayer should know to protect themselves. This comprehensive guide covers common audit red flags, practical tips to avoid audits, detailed steps for preparation, and insights into the ever-changing regulatory landscape in Texas. Whether you’re an individual taxpayer or a small business owner, our expert analysis explains real-world scenarios, debunks prevailing myths, and outlines how IRS Prob can support you. Delve into frequently asked questions and professional tips that clarify the audit process while offering actionable advice. Stay informed and confident in your tax practices with this essential resource tailored specifically for Texas taxpayers. Continue reading to empower yourself with the knowledge needed to navigate the complex world of IRS audits in Texas.

Discover everything you need to know about the ultimate tax preparation guide tailored specifically for Texas families. This comprehensive blog post delves into the nuances of Texas tax laws, best practices for gathering essential documents, and strategies to maximize your deductions and credits. Whether you’re navigating the complexities of tax season for the first time or looking for expert advice on avoiding common pitfalls, our guide covers every aspect of “ultimate tax preparation texas families.” From choosing the right tax professionals to planning effectively for future years, this post offers actionable insights to ensure that Texas families not only comply with tax regulations but also optimize their financial wellbeing. Read on to empower your tax preparation journey with proven tips, in-depth analysis, and expert strategies designed to make tax season stress-free and financially rewarding.

Effective Tax Resolution Strategies for Troubled Texas Taxpayers dives deep into the challenges facing Texans with tax debt and outlines proven solutions under the umbrella of “strategies for tax resolution texas.” This comprehensive resource from IRS Prob examines the root causes of tax troubles, explores negotiation tactics with the IRS, and provides practical, long-term financial planning advice. Readers will benefit from expert guidance that covers everything from understanding the implications of tax debt to preventative measures ensuring future compliance. With detailed sections addressing the legal nuances of IRS negotiations and the benefits of partnering with seasoned professionals, the post empowers individuals to tackle tax challenges with confidence. Whether you’re struggling with back taxes, overwhelmed by penalties, or simply looking to fortify your financial future, this guide offers actionable insights and step-by-step advice to reclaim control of your finances. Read on to discover professional tips, real-world examples, and a FAQ section that answers your burning questions about effective tax resolution strategies in Texas.

Navigating tax challenges can be a daunting task, especially for Texas homeowners who face the looming threat of IRS levies. In this comprehensive guide, we dig deep into the intricacies of IRS levies, offering actionable advice, financial planning strategies, and expert insights specifically tailored for Texas residential taxpayers. With detailed explanations of common triggers, practical steps to stay compliant, and resources for professional assistance, this guide empowers you to take control of your finances and avoid IRS levies. Whether you’re dealing with unexpected tax bills or planning ahead, our in-depth analysis and step-by-step instructions ensure that you can safeguard your home and financial well-being. Dive in and discover how to effectively manage tax responsibilities, mitigate risks, and secure your financial future by learning how to avoid IRS levies Texas homeowners.

Federal tax liens can have a lasting effect on your credit, especially in Texas, where financial regulations and property values complicate matters even more. This comprehensive article dives deep into the intricacies of federal tax liens and their impact on credit scores in Texas, offering clear explanations, actionable strategies, and expert guidance tailored to residents and property owners in the Lone Star State. By exploring everything from the origin of these liens to the nuances of Texas law and the myths that often cloud public understanding, we provide readers with the knowledge and tools necessary to navigate these challenges. Whether you’re currently dealing with a lien or planning to protect your credit score moving forward, this guide will equip you with the insights needed to take control of your financial future. Read on to learn more about federal tax liens credit Texas considerations and how IRS Prob is here to help.

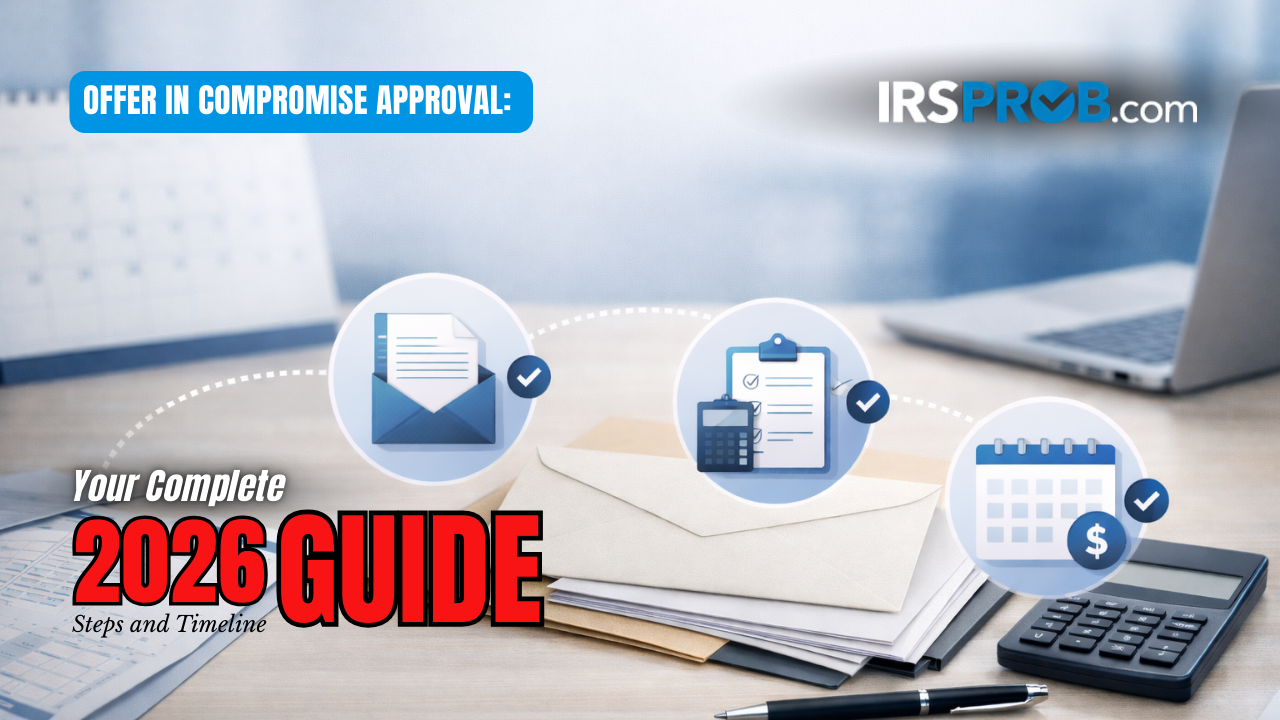

When facing overwhelming tax debt in Texas, mastering the Offer in Compromise process offers a beacon of hope for taxpayers seeking relief. This comprehensive blog post provides an in‐depth look at how to navigate offer in compromise texas, including crucial eligibility criteria, preparatory financial documentation, and expert strategies for overcoming common obstacles. Readers will discover a step‐by‐step guide to understanding the procedure, learn how to address challenges, and glean insights into the ever‐changing landscape of tax resolution in Texas. Whether you are a taxpayer aiming to negotiate a fair settlement with the IRS or a professional representing clients, this post delivers expert advice, practical tips, and real-life examples designed to demystify the process and set you on the path to success. Read on to unlock essential information, strategic guidance, and insider tips that will empower you to master your Offer in Compromise process with confidence and clarity.

Discover everything you need to know about IRS installment agreements tailored for small businesses in Texas in this extensive guide by IRS Prob. We delve into the benefits, eligibility criteria, detailed application processes, and best practices to manage financial documentation and IRS communications. With a special focus on IRS installment options texas small business, this blog post explains how small business owners can navigate tax challenges, mitigate risks, and strategically leverage installment plans to maintain cash flow. Whether you’re struggling with back taxes, seeking clarity on the IRS application process, or looking for alternative tax relief options, our comprehensive guide provides professional insights, actionable steps, and expert advice to help you secure the right installment agreement and keep your business thriving.

Innocent Spouse Relief Texas Stories: Real Texans Share Their Experiences provides an in‐depth exploration of how real Texans have navigated the complexities of innocent spouse relief. This blog post delves into personal journeys, expert guidance, legal insights, and practical tips for overcoming the challenges faced when dealing with IRS liabilities. With narratives that reflect perseverance and success, readers will gain a comprehensive understanding of the process, the pitfalls to avoid, and how to position themselves for a favorable outcome. Whether you’re just starting to explore your options or are already deep in the process, this engaging piece offers valuable lessons and a sense of hope for anyone impacted by joint tax issues in Texas. Discover inspiring stories, proven strategies, and essential advice from professionals at IRS Prob, ensuring that the path to relief is understood, accessible, and achievable.

In the complex world of taxation, making the right decision to choose tax consultation Texas service is crucial for your financial well-being. This comprehensive blog post, brought to you by IRS Prob in Texas, guides you through every aspect of selecting a tax consultation service that fits your unique needs. We explore the tax landscape in Texas, define your consultation requirements, and share detailed insights on evaluating service providers. With practical steps, expert advice, and an in-depth look at the benefits of hiring professionals from IRS Prob, you’ll learn how to navigate the challenges of tax regulations while ensuring compliance and maximizing deductions. Whether you’re an individual taxpayer or a business owner facing intricate tax matters, our post empowers you with the knowledge to make informed decisions. Read on to uncover key considerations, practical tips, and expert recommendations that will set you on the right path toward successful tax management in Texas.

In today’s unpredictable financial climate, protecting your assets from IRS levies in Texas is of paramount importance. Our comprehensive guide, tailored specifically for Texans, delves into expert strategies that empower you to safeguard your finances, property, and peace of mind. Through detailed insights on the IRS levy process, proactive planning, and the indispensable role of professional assistance from IRS Prob, we help you navigate this complex terrain with confidence. Whether you’re a homeowner, business owner, or individual taxpayer, this blog post offers practical advice, step-by-step instructions, and proven methodologies to protect assets from IRS levies Texas. Read on to discover how careful tax planning, understanding your rights, and partnering with experts can make a critical difference in your financial security and long-term success.

This comprehensive guide, “Decoding IRS Notices: A Practical Guide for Texas Residents,” provides an in‐depth look at how Texans can understand, decipher, and respond to IRS communications with confidence. From identifying the types of IRS notices and their potential implications to actionable steps on responding and appealing when necessary, this resource is designed to empower Texas residents. Using clear, concise explanations enriched with expert tips, the guide demystifies the process of handling IRS notices and offers practical “IRS notices texas guidance” tailored for Texans. Whether you’re a first‐time recipient or a seasoned taxpayer dealing with complex legalities, this post offers essential insights, real-world examples, and proven strategies to navigate IRS communications. Read on to discover key takeaways, comprehensive FAQs, and professional advice that will help you manage IRS notices effectively and protect your financial well-being in the Lone Star State.

Discover the ultimate guide to removing a federal tax lien in Texas fast with our detailed blog post crafted by IRS Prob experts. In this comprehensive post, you’ll learn everything from understanding federal tax liens, navigating legal complexities, and mastering recovery strategies, to the step-by-step process that enables taxpayers to reclaim financial freedom quickly and efficiently. Whether you’re dealing with a looming tax lien or seeking to prevent future issues, our expert insights, legal considerations, and in-depth financial analysis provide the clarity and direction you need. Read on to empower yourself with actionable strategies, success stories, and professional tips tailored specifically for Texas residents. Find out how to remove federal tax lien texas fast while ensuring your financial health and credit integrity remain intact.

In this comprehensive guide, we dive deep into the essential strategies and actionable steps Texas taxpayers can use to avoid IRS audits. Tailored for residents of the Lone Star State, our “avoid IRS audits texas roadmap” outlines a clear, step-by-step plan to help navigate the complexities of IRS scrutiny. From understanding the audit process and identifying common audit triggers to mastering record-keeping and leveraging professional tax resources, this roadmap is designed to equip you with the knowledge and confidence to protect your financial integrity. Whether you’re a self-employed entrepreneur or a family managing multiple income streams, our detailed insights and real-world tips will help you stay compliant and avoid unnecessary complications. Continue reading to discover how you can proactively safeguard your returns and ensure peace of mind during tax season.

In today’s complex tax landscape, understanding trust fund recovery penalties in Texas is crucial for every business owner. This comprehensive guide delves into the origins, implications, and enforcement practices of trust fund recovery penalties texas. With detailed insights on the legal framework, financial impact, and practical strategies for mitigation, Texas businesses can equip themselves with knowledge to prevent costly mistakes and manage risks effectively. We explore IRS audit procedures, share real-world case studies, and offer expert recommendations to help you navigate these penalties confidently. Whether you’re a startup or an established enterprise, our in-depth analysis and professional tips provide the clarity needed to secure your financial future and maintain compliance with IRS standards. Read on to empower your business with the essential information you need to thrive in an ever-evolving regulatory environment.

Tax resolution in Texas is a critical subject for individuals and businesses grappling with IRS challenges. This comprehensive blog post delves into the intricacies of resolving tax issues, focusing on Texas-specific solutions that can ease the burden of IRS disputes. From understanding the foundational principles of tax resolution to exploring effective strategies and communications with the IRS, readers will gain insight into navigating complex tax scenarios. The post highlights the importance of local expertise, showcases successful case studies from Texas, and provides actionable steps on how to work with IRS Prob. With step-by-step guidance and expert advice, this article will empower Texans to take control of their tax challenges and create a sustainable pathway to financial relief. Continue reading to discover the strategies that make tax resolution Texas solutions a game changer for any taxpayer facing IRS complications.

This ultimate guide provides a deep dive into tax relief Texas programs and how they work for homeowners and business owners alike. Discover the ins and outs of obtaining relief, eligibility criteria, application processes, and the significant benefits available through these programs. Written specifically for Texas residents, this guide explains the strategies to navigate complex tax situations, dispels myths, and offers practical advice for overcoming common challenges. Whether you’re struggling with high property taxes, seeking long-term financial planning strategies, or looking for success stories from fellow Texans, this comprehensive guide on tax relief texas programs guide is your one-stop resource for actionable insights and expert advice. Read on to learn how you can transform your tax burden into a manageable part of your overall financial strategy and gain peace of mind in the process.

In today’s rapidly evolving financial landscape, comprehensive tax preparation services are essential for Texas residents and businesses alike. This in‐depth blog post explores the myriad benefits and best practices of professional tax preparation, with a special focus on “tax preparation texas benefits.” Readers will discover how expert services, like those offered by IRS Prob in Texas, simplify tax filing, reduce financial risks, and uncover significant savings. From understanding the detailed tax preparation process to mastering the latest tax regulations and filing best practices, this guide covers every facet of tax management. With actionable insights, clear step-by-step explanations, and professional tips, our post demystifies the complexities of tax preparation and provides actionable strategies to secure future tax advantages. This comprehensive resource is a must-read for Texans seeking to optimize their tax returns, minimize liabilities, and maximize deductions while staying compliant with changing federal and state guidelines.

Discover everything you need to know about expert tax consultation services in Texas with our comprehensive guide. Designed specifically for IRS Prob clients in the Lone Star State, this article dives deep into the nuances of tax consultation Texas review, outlining the importance of professional guidance, offering insider tips on evaluating services, and addressing common challenges taxpayers face. From understanding the basics of tax consultation to exploring future trends in the industry, we’ve compiled expert insights and actionable advice to help you navigate complex tax laws and maximize your financial well-being. Whether you’re a small business owner or an individual seeking personalized support, this resource empowers you to make informed decisions and secure reliable expertise in an ever-changing regulatory landscape. Read on to transform your tax preparation strategy with trusted, expert advice.

Finding the right tax lawyer in Texas can be a game-changer for anyone facing complex tax issues. In this comprehensive guide, IRS Prob breaks down the essential factors to consider during your search for a top-tier legal expert in tax law. We delve into the importance of experience, credentials, and local knowledge, while also offering detailed insights on evaluating a candidate’s track record and client testimonials. Whether you’re dealing with IRS disputes or need proactive tax planning strategies, this blog provides a step-by-step roadmap. With in-depth sections, actionable takeaways, and a helpful FAQ segment, you’ll gain clarity on how to make an informed decision during your tax lawyer Texas selection journey. Continue reading to empower yourself with the knowledge to navigate the legal complexities and secure robust legal support in the heart of Texas.

In the intricate world of tax resolution, settling tax debt with an offer in compromise presents a viable, strategic alternative for Texans overwhelmed by IRS challenges. “Settling Tax Debt with an Offer in Compromise: Texas Edition” delves deep into the nuances of this solution, offering actionable insights and practical guidance on leveraging the offer in compromise Texas debt settlement strategy. This comprehensive blog post explains eligibility requirements, the application process, common challenges, and potential alternatives, while shedding light on how IRS Prob in Texas can streamline your journey to financial relief. Whether you’re a small business owner or an individual taxpayer in Texas, our expert analysis, real-life case studies, and step-by-step breakdown empower you to overcome tax burdens and regain financial stability. Read on to unlock proven techniques and insider strategies crafted specifically for Texas residents navigating the complexities of tax debt resolution.

In this comprehensive guide for Texas taxpayers, we explore the critical steps to prevent IRS levies and secure your financial future. Delve into the dynamics of IRS levies, understand the common pitfalls that Texas residents encounter, and learn practical strategies to stay ahead of potential tax enforcement. From understanding the intricacies of the IRS dispute process to effective documentation and recordkeeping techniques, this article serves as a one-stop resource for anyone looking to safeguard their assets and maintain financial stability. With real-world examples, actionable advice, and expert insights, our guide is tailored to the unique landscape of Texas taxation. Whether you’re facing tax pressure or preparing to avoid it altogether, these prevent IRS levies Texas tips are your roadmap to proactive tax management. Read on to empower yourself with the knowledge and strategies needed to confidently navigate IRS challenges, reduce risks, and make well-informed financial decisions.

Discover an in‐depth, step‐by‐step guide to navigating IRS installment agreements in Texas. This comprehensive post from IRS Prob unpacks everything Texans need to know—from understanding the basics of IRS installment agreements to gathering the crucial documentation, meeting eligibility requirements, and executing each step of the application process. Readers will learn practical tips on managing payments and addressing adjustments, all while avoiding common issues that may derail their plans. With detailed insights, expert guidance, and an FAQ section answering all your burning questions, this guide is an indispensable resource for Texans seeking a manageable way to resolve tax debts through IRS installment agreements. Read on to demystify the process, gain actionable advice, and feel empowered to take control of your financial future.

Innocent Spouse Relief in Texas has become a crucial option for many taxpayers facing challenging IRS issues due to a spouse’s or ex-spouse’s tax missteps. This post delves into who qualifies for innocent spouse relief in Texas, explains the detailed application process, and highlights Texas-specific nuances that every taxpayer should know. Whether you’re concerned about unexpected tax liabilities or seeking clarity on IRS Prob’s role in Texas, our comprehensive guide covers eligibility criteria, common hurdles, helpful case studies, and practical steps to build a successful application. Read on for an in-depth look and expert tips designed to help you navigate the complexities of innocent spouse relief texas qualification and secure the relief you deserve.

Navigating IRS Audit Help in Texas can seem overwhelming, but this comprehensive guide from IRS Prob is here to deliver expert advice for every taxpayer facing tax challenges. In this in-depth blog post, we dive into the IRS audit process, detail the crucial steps for preparation, and highlight common audit triggers to help you avoid costly mistakes. Whether you’re a seasoned Texas taxpayer or new to navigating the intricacies of IRS procedures, our expert advice ensures you’re well-equipped to handle any audit situation confidently. With actionable insights, taxpayer rights explained, and proven strategies for resolution, this guide is your roadmap to secure and effective audit management. Discover the future trends in IRS audits and essential pro tips that empower you to take control of your financial well-being in Texas. Read on to transform your audit experience with professional guidance tailored to your unique needs.

Federal Tax Liens in Texas can be a daunting aspect of financial and legal management, especially if you’re facing IRS challenges. This comprehensive guide dives into the intricacies of federal tax liens in Texas, offering an in‑depth look at how these liens work, their impact on your assets and credit, and the step‑by‑step filing process. Exploring federal tax liens texas guide strategies, our detailed insights help you understand the legal framework, essential compliance requirements, and methods for resolving these liens efficiently. Whether you’re a homeowner, property investor, or legal professional, this guide from IRS Prob provides actionable advice, strategic tips, and expert answers to frequently asked questions, ensuring you are well‑prepared to manage your tax lien challenges. Read on to unlock the secrets behind federal tax liens in Texas and gain the clarity needed to protect your financial future.

Gambling feels like a shot at easy money—until tax time rolls around. Win or lose, the IRS is always at the table, and the tax

Members of the U.S. Armed Forces and veterans often have unique tax situations and needs. Recognizing the sacrifices they make, the IRS provides specific tax

Uncover the audit process and what to expect if you are selected for an IRS audit. Contact us at 866-861-4443 for expert guidance.

Discover the intricacies of innocent spouse relief and how it can protect you from tax liabilities. Reach out to us at 866-861-4443 to learn more.

Explore how a federal IRS tax lien can affect your property ownership and learn how to navigate the complexities. Call us at 866-861-4443 for assistance.

As a business owner, it’s essential to understand the requirements surrounding Form 1099-MISC and Form 1099-NEC reporting. These forms are critical in ensuring compliance with

When it comes to fraud and tax evasion, it’s not just a matter of breaking the law—it’s a betrayal of trust that impacts everyone involved,

Providing financial support to aging parents or in-laws while managing child care needs can be taxing. Learn how converting support payments to child care payments can qualify you for a dependent care credit, easing your tax burden and benefiting your family in our latest blog post.

Each year, the IRS releases a list of the most prevalent tax scams, known as the “Dirty Dozen,” to help taxpayers avoid fraudulent schemes that can lead to financial and legal troubles. One significant scam is the rise of Offer in Compromise (OIC) Mills, where unscrupulous entities falsely promise to negotiate with the IRS to reduce tax debts, often charging hefty upfront fees for ineffective or non-existent services.

Salvatore Groppo’s guilty plea for involvement in an unlawful sports gambling operation did not shield him from substantial IRS tax liabilities. Despite fulfilling his probation terms, Groppo faced over $100,000 in excise tax and penalties, which he unsuccessfully tried to settle. His appeal to expunge his felony conviction, aimed at negating the IRS’s tax assessment, was denied by the 9th Circuit Court. The court emphasized that the plea deal did not bind other authorities, reaffirming that tax liabilities remain despite a plea agreement.

Dariusz Pietron, owner of TJM Construction, Inc. and Point Construction, Inc., has pleaded guilty to defrauding the IRS and Travelers Insurance Company by failing to report employee wages and pay required employment taxes, and underreporting wages to reduce workers’ compensation insurance premiums. This scheme led to over $1.1 million in unpaid taxes and $244,000 in defrauded insurance premiums. Pietron faces up to 25 years in prison and substantial fines. This case highlights the severe consequences of tax fraud and underscores the importance of compliance for business owners.

The IRS is facing a significant challenge in combating bad tax advice circulating on TikTok, a platform it cannot access due to federal restrictions. National Taxpayer Advocate Erin Collins highlighted this issue, explaining the difficulties in reaching users who rely on social media for tax guidance. The IRS has included misleading tax information on its Dirty Dozen list of tax scams and issued alerts on various credits being misused. Business owners are urged to rely on official IRS resources and trusted tax professionals to avoid falling victim to misinformation.

As a business owner, navigating self-employment taxes can be challenging, especially if you’re an active limited partner in a partnership. Recent IRS rulings and court decisions have clarified that simply holding the title of a limited partner isn’t enough to avoid these taxes if you actively participate in the business. Understanding the implications of these changes and exploring alternative business structures like S corporations can help you strategically minimize your tax liabilities.

The federal government has issued over $1 billion in upfront tax credits to buyers of new and used electric vehicles (EVs) as part of the Inflation Reduction Act. This initiative, which began on January 1, 2024, allows car buyers to receive tax credits of up to $7,500 for new EVs and $4,000 for used EVs directly at the point of sale, making EVs more affordable and competitive with traditional gasoline-powered vehicles.

Combining business travel with personal leisure can be a smart way to take a break while also saving on taxes. By ensuring that the primary purpose of your trip is business-related and keeping thorough records, you can maximize your deductions and enjoy some well-deserved downtime.

Understanding the IRS’s refund statute of limitations is crucial, especially if you’ve missed filing your tax returns for several years. Learn how to navigate the complexities of reclaiming overpaid taxes and avoid losing your hard-earned refunds by staying on top of your annual tax filings.

As a business owner, properly managing your employment tax obligations is not just a legal requirement—it’s a crucial aspect of running a successful and ethical business. The potential consequences of failing to do so, as illustrated by this recent case, are simply too severe to ignore. Stay informed, stay compliant, and don’t hesitate to seek professional help if you’re unsure about your tax obligations.

This blog post examines the case of a former golf professional sentenced for tax fraud, highlighting the severe consequences of evading taxes and skimming business revenues. It offers valuable lessons for business owners on maintaining accurate records, understanding tax obligations, and the importance of compliance to avoid legal and financial repercussions. The post also provides insight into the role of the IRS Criminal Investigation division in prosecuting tax-related crimes.

This blog post explains why S corporation owners shouldn’t rent their home office to their business and instead opt for employee reimbursement. It outlines the tax-efficient strategy of having the S corporation reimburse the owner for home office expenses, detailing the process and benefits of this approach for maximizing tax savings.

This post explains how business owners can get a valuable tax deduction by writing off the remaining basis of an old roof, elevator, HVAC system or other building components when replacing them. It covers the three key benefits: an immediate tax deduction, reducing depreciation recapture tax later, and the time value of investing the upfront tax savings. An example illustrates just how lucrative this strategy can be for boosting cash flow.

The IRS recently released its annual “Dirty Dozen” list of prevalent tax scams that business owners need to watch out for, ranging from phishing attempts and employee retention credit fraud to fake charities and abusive tax avoidance schemes. By being aware of these common scams and taking proactive measures, businesses can protect themselves from costly penalties, identity theft, and legal consequences

The Tax Court denied equitable relief to a taxpayer seeking Innocent Spouse Relief after his ex-wife improperly claimed deductions on their joint tax return. Despite meeting several conditions, the court ruled that the taxpayer’s lack of involvement in reviewing the return and claiming a refund undermined his claim of innocence.

Deciding who should own the business car—yourself or your corporation—is a crucial decision for single-owner S corporations. This choice impacts insurance rates, tax deductions, and administrative complexity. Individual ownership may offer better insurance rates, but it complicates reimbursements and tax reporting.

The IRS is set to intensify its audit activities thanks to an $80 billion boost from the Inflation Reduction Act. This funding aims to revitalize the agency, which has faced years of underfunding, resulting in customer service issues and decreased audit rates. Wealthy individuals and large corporations will be the primary focus of these increased audits.

Closing your sole proprietorship involves more than just shutting the doors. Understanding the tax implications is crucial. In our latest blog post, we break down the key considerations when shutting down your business, from asset sales to tax strategies.

When taxpayers file a joint tax return, both spouses are jointly and severally liable for the entire tax due. However, there’s an exception if fraud is involved, allowing tax liability to be appropriately allocated. In a recent case, a husband sought Innocent Spouse Relief after his ex-wife filed their 2016 tax return without his knowledge, deducting significant unreimbursed employee business expenses. Despite meeting several conditions for relief, the tax court denied his request, emphasizing the importance of reviewing tax returns before filing. This case highlights that ignorance of return contents cannot shield one from liability.

As tax season comes to a close, many taxpayers can finally relax after filing their returns. However, some may realize they made errors or omissions that need correcting. If you find yourself in this situation, don’t panic – there are steps you can take to fix your mistakes and potentially avoid costly penalties.

The Internal Revenue Service is back with its hand out, pleading for over $100 billion in new funding from Congress. This comes despite the agency receiving a massive $60 billion cash infusion just last year from the Inflation Reduction Act.

Closing your sole proprietorship or single-member LLC? Understanding the tax implications is crucial. Selling your business assets triggers various tax considerations, including special rules for real estate, different tax treatment for various assets, and non-compete agreement payments taxed as ordinary income. Navigating these tax implications requires careful planning. We’re here to help at IRSProb.com

Did you know the IRS can charge you up to a 25% penalty for filing your tax return late? Many people don’t realize that you can avoid this hefty penalty by filing on time, even if you can’t pay the full amount you owe. At IRSProb.com, we’ve seen countless individuals save thousands by simply filing on time.

When it comes to retirement planning, married couples have a unique advantage that can significantly boost their savings: the Spousal IRA. This often-overlooked tax break allows a working spouse to contribute to an Individual Retirement Account (IRA) on behalf of a non-working or lower-earning spouse. In this post, we explore how you can leverage a Spousal IRA to enhance your retirement nest egg, covering eligibility requirements, contribution limits, tax benefits, and strategic advantages.

Series LLCs have emerged as an innovative business structure that allows a master LLC to create separate “series” with compartmentalized assets and liabilities. While they offer potential benefits like asset protection and cost efficiency, series LLCs also come with uncertainties surrounding their legal status and tax treatment.

### Excerpt

Cost segregation is a powerful tax strategy for owners of residential rental and commercial properties. By breaking down a property into its various components, owners can accelerate depreciation deductions, resulting in significant tax savings, especially in the first few years of ownership. This comprehensive guide explains how cost segregation works, its benefits and potential drawbacks, and when it’s most advantageous to conduct a cost segregation study. Whether you’re a seasoned property investor or just starting out, understanding this strategy can help you optimize your tax benefits and improve your investment returns.

Blog Post Excerpt:

Dealing with IRS penalties can be overwhelming, with over 148 different types potentially adding significant costs to your tax bill. However, many of these penalties can be reduced to zero if you can demonstrate reasonable cause, such as medical issues, bad advice, or natural disasters. Learn how to navigate the process of penalty abatement, potentially saving yourself thousands of dollars, and find out why professional tax help can make all the difference. Don’t let IRS penalties weigh you down – take control of your financial future today.

Navigating the intricacies of tax deductions for business meals can be challenging, especially with the IRS’s Sutter rule potentially reducing or denying your claims. In “Navigating the Tax Maze: How to Safeguard Your Dutch-Treat Business Meal Deductions,” we unravel the nuances of this rule, highlight triggers that might attract IRS scrutiny, and provide practical strategies to protect your deductions. Discover how to effectively document your business meal expenses to ensure they are recognized as legitimate, deductible costs.

The Dirty Dozen represents the worst of the worst tax scams. Compiled annually by the IRS, the Dirty Dozen lists a variety of common scams

The Dirty Dozen represents the worst of the worst tax scams. Compiled annually by the IRS, the Dirty Dozen lists a variety of common scams

Are you looking for a game-changing way to ramp up your retirement savings? Enter the mega backdoor Roth IRA strategy. While the traditional backdoor Roth

In a recent verdict, the Tax Court addressed critical facets concerning spousal relief from unpaid taxes, spotlighting evidence admissibility and the criteria for granting relief

5 Ways to Avoid a Tax Audit in Texas,Tax Audit

Facing IRS Penalties? Understanding Your Options,IRS Penalties

Tax Debt? Heres Your Texas Tax Relief Guide,Tax Debt

The lien really becomes an issue though when the IRS takes that lien and they file a notice of it, a NOTICE OF FEDERAL TAX LIEN. This is what becomes public record at the courthouse. They file this with the courthouse and it really affects a taxpayer–especially one trying to either buy or sell property. It really can be a showstopper if it’s still in existence when the property goes to closing. That’s when it really pops up. If they’re trying to buy property, there’s not too many banks that want to loan money to somebody that has a federal tax lien on their record.

Get reliable and efficient tax help from IRSProb in Texas guiding you through every tax challenge.

IRSProb in Texas specializes in resolving challenging tax problems with professionalism and care.

IRSProb offers skilled legal expertise for complex tax issues in Texas ensuring compliance and savings.

Maximize your tax strategy with IRSProb’s comprehensive tax consultation services in Texas.

Discover how IRSProb provides expert tax relief services in Texas ensuring your financial peace of mind.

Navigate the murky waters of IRS audits and business betrayals with IRSProb, your Texas-based tax relief experts. Learn more on our page!

Join IRSProb, a Texas tax relief specialist, as we salute our veterans. Discover how we express gratitude for their service.

Join IRSProb this Thanksgiving as we express gratitude to our clients. Your tax issues are our victories! Visit our heartfelt message.

Join us at IRSProb.com as we express our heartfelt gratitude to our clients this Thanksgiving. Tax relief made better by your trust!

Stay updated with IRSProb’s insights on IRS’s new proposal to modernize seized property sales. Know how it impacts tax liens and audits.

Celebrate Labor Day with IRSProb.com! Your Texas-based partner for tax relief, liens, and IRS audits. Relax, we’ve got your taxes covered!

Unravel the mystery of tax debt relief with IRSProb, your Texas tax relief specialists. Navigate IRS audits, tax liens with ease!

Navigate your tax woes with IRSProb.com’s expert advice. Discover 5 key steps to tax relief. Tax liens, IRS audits simplified. Maximize your savings now!

Navigate IRS negotiations with confidence using our expert tips. Learn from Texas’s top tax relief pros at IRSProb!

Navigate small business tax woes with IRSProb’s expert guidance. Unravel tax liens, audits & more from our Texas tax relief specialists.

Navigate IRS tax issues with ease! Explore IRSProb’s comprehensive guide on tax resolution options and find relief today. Texas’s tax experts.

Dive into the intriguing past of income taxes with IRSProb. Perfect for a July reflection! Tax relief expertise meets history lesson.

Navigate the complex world of U.S. estate tax for non-citizens. Unravel domicile, situs, and tax treaties with IRSProb’s expert insights.

Celebrate Independence Day with IRSProb.com – your Texas tax relief ally. For freedom from tax liens and IRS audits, click now!

Celebrate Independence Day stress-free with IRSProb.com! Let our Texas-based experts help with tax relief, liens, and IRS audits.

Explore how IRS guidance impacts college NIL Collectives. IRSProb provides key insights on tax relief and audits in this context.

Stay updated with IRSProb’s Summer 2023 legislative changes! Navigate tax relief, liens, and audits with our Texas experts.

Unlock the potential of 529 plans for college savings with IRSProb. Learn how to maximize your education savings today!

Beware, business owners! Navigate ERC scams with IRSProb, your Texas tax relief ally. Our expertise safeguards your assets from tax fraudsters.

Get savvy with IRSProb’s guide on differentiating business, hobbies, and investments for tax purposes. Avoid IRS headaches today!

Feeling crushed under a massive IRS tax debt? Discover how we slashed a $295,865 liability to just $7,500 at IRSProb, your Texas tax relief experts!

Trouble’s brewing for Teresa Giudice with a new federal tax lien, amidst the Real Housewives reunion. Stay updated with IRSProb.

Struggling with the IRS’s long arm? IRSProb offers expert solutions to tax reliefs, liens, and audits. Beat the tax blues with us!

IRSProb delves into IRS’s exploration of a direct file option, assessing its feasibility and prospective pilot project. Stay updated on tax relief trends!

Unlock the enigma of property seizures in tax disputes. Dive into IRSProb’s expert insights on tax relief and IRS audits. Unravel the mystery now!

Discover how the suspension of debt ceiling limits till post-election can impact taxes. Get expert analysis from IRSProb, your trusted tax relief partner.

Facing IRS collection troubles? IRSProb Texas can help settle your tax debts smoothly. Visit us and fight back with expert tax relief solutions!

Maximize your savings with IRSProb’s guide on the once-in-a-lifetime IRA-to-HSA rollover. Smart tax strategies for a secure future.

Unlock the secrets of Real Estate Professional Status and overcome tax hurdles with IRSProb, your trusted Texas tax relief experts.

Discover how a Florida dentist landed in hot water for tax evasion and false returns. A lesson in the importance of tax honesty, brought to you by IRSProb.

Explore how hiring your kids could unlock tax-free education benefits. Learn the IRS rules with Texas’ top tax relief specialists, IRSProb.

Boost your team’s performance with IRSProb’s Business Gym – tax relief and audit skills training that might just flex your own muscles too.

Master the $75 rule for business expenses with IRSProb, your Texas tax relief specialist. Navigate tax liens and audits like a pro!

Honor Memorial Day with IRSProb.com! Your Texas tax relief experts, tackling tax liens and IRS audits with valor.

Learn clever strategies to sidestep passive loss limits on short-term rentals, and master your tax game with IRSProb.

Unearth the tale of a remodeler contractor’s $1.9M tax scam gone wrong. A gripping IRSProb case study on the perils of underreporting income.

Alabama tax preparer’s 20-month sentence for fraudulent returns – a cautionary tale from IRSProb, your Texas tax relief experts.

Discover how an attorney’s tax fraud led to license suspension, a stark reminder that no one is above IRS scrutiny. IRSProb – solving tax troubles.

Uncover the thrilling tale of a luxury car exporter’s $18M tax evasion on IRSProb. Buckle up for a wild ride in tax relief mysteries!

Real Housewives Star Kim Zolciak and spouse Kroy Biermann face IRS chase over $1M back taxes. Get the inside scoop on IRSProb.

Discover how a former Arkansas senator’s tax fraud and bribery case unfolded. A cautionary tale of political corruption from your trusted tax experts at IRSProb.

Beware of CPA impostors! Discover the tale of a fraudster who swindled hundreds of clients, breaking trust and wallets at IRSProb.com.

Facing tax troubles? Read how a Florida man received a 30-month sentence for tax evasion. Don’t become a headline, get expert tax help with IRSProb.

Unearth the tale of a contractor’s million-dollar tax fraud & his swift journey to jail. An IRSProb lesson on why to always play fair with payroll taxes.

Dive into the tale of a man’s 20-month sentence for tax evasion. A stern reminder from IRSProb – don’t dance with the taxman, Texas!

Caught in a high stakes game, a restaurateur faces hard time for tax evasion. Discover his downfall at IRSProb, your tax relief experts.

Angela Clay, newly-elected Chicago alderman, conquers polls despite an $18,450 IRS lien. Get the full scoop on IRSProb.com.

Learn how IRS and State Treasuries lost millions to 122 false tax returns at IRSProb, your Texas tax relief specialists.

Discover how IRSProb, a Texas tax relief expert, navigated a widow’s daunting $123,677 IRS claim. Learn from our success story!

Discover how a Montana contractor’s 8-year 941 tax evasion landed him in prison. An essential read for avoiding IRS troubles.

Discover the consequences of an 8-year tax hiatus, and how IRSProb, a Texas tax relief firm, steps in to salvage the situation. Visit our page now!

Discover how one man’s mix of tax evasion, drug dealing, and charity fraud unraveled. Learn from his mistakes at IRSProb.

Discover how an Ohio dentist’s tax evasion since ’92 led to a 4-year sentence, gold bars, and silver coins seized. A cautionary tale from IRSProb.

Uncover the shocking tale of a bookkeeper turned thief. Learn how IRSProb can protect your business from such tax nightmares.

Discover the tale of a man’s 310-day prison sentence due to tax evasion. A cautionary tale from IRSProb, your Texas tax relief experts.

Uncover the shocking tale of an employee’s $1.8M scam that left an employer stunned. A must-read case study from Texas’ IRSProb experts.

Facing tax woes? Read how an engineering firm owner evaded taxes and the repercussions that followed. Don’t be next. IRSProb can help!

Learn how a Texas businessman dodged taxes using payroll restructuring, and how IRSProb can help you navigate complex tax issues.

Discover how a financial manager slyly rerouted company funds into her own pockets. A cautionary tale from IRSProb, your tax relief expert.

Teen Mom stars Catelynn Lowell & Tyler Baltierra settle tax debts! Discover how IRSProb can help you navigate tax woes too.

Michigan man trips up on tax troubles, deceives court & Justice Department. Dive into the details of this jumbled justice journey.

Discover how a tax preparer landed in hot water for filing false returns. A cautionary tale for all, served fresh from IRSProb, your Texas tax relief expert.

Uncover how a pair of restaurateurs cooked up a $1M tax fraud, landing themselves house arrest. IRSProb reveals all.

Caught off guard with a $65,000 IRS notice? IRSProb sheds light on innocent spouse tax relief options. Stay informed, Texas!

Arizona resident faces justice in tax evasion case. Dive into IRSProb’s expert analysis of how not to be the next headline.

Discover how a judge upheld a 16-year tax collection effort. Get insights from IRSProb, Texas’ top tax relief experts. Explore now!

Discover how singer Chris Brown landed a $3M tax debt. IRSProb, your Texas tax relief expert, dives deep into this high-profile case!

Discover how a Republic lawmaker turns up the heat on the Treasury Inspector regarding IRS data leaks. IRSProb has the scoop!

Explore how the IRS’s antiquated IT systems are causing significant issues. Get insights from IRSProb, your Texas tax relief specialists.

Explore IRSProb’s insights on why the IRS urgently needs a tech upgrade for efficient tax processing and better taxpayer services.

Tax woes? Learn from this towing company owner’s 15-month sentence for $130K unpaid taxes. Never tow the line with IRS!

Discover the intriguing tale of tax preparers who filed 1,000 false returns and faced the music. IRSProb: making tax tales a cautionary lesson.

Learn how Biden’s IRS pick, Daniel Werfel, promises tax relief for middle and working-class folks. No more audit nightmares with IRSProb!

Facing jail for tax evasion? Read the story of a man risking 5 years in prison for tax issues at IRSProb – your Texas tax relief experts.

Discover how one man used a ‘zapper’ to lower his taxable income. Unravel the mystery with IRSProb, your Texas tax relief experts!

Tax relief specialist IRSProb reports on Michael Avenatti’s 14-year federal prison sentence. Catch the details on our latest post.

Uncover the intriguing tale of an investment advisor’s downfall due to tax fraud. A must-read for all investors. Beware and be informed!

Discover how a rogue payroll company owner twisted the system for personal gain, only at IRSProb – your trusted tax relief experts in Texas.

Discover how a Texas woman’s illicit banking maneuvers led to prison time for wire fraud and unreported income to the IRS. Don’t be next!

Uncover the scandal of Kansas City’s CFO of the Year turned felon! A tale of deceit, millions embezzled, and IRS repercussions.

Store owner, post $2M in kickbacks, gets a permanent ‘kick back’ behind bars. Catch the full scoop on IRSProb, your Texas tax relief experts.

Dive into IRSProb’s guide on the harsh realities of payroll tax evasion. Texas tax relief experts expose the risks, avoid the pitfalls!

Bite into this juicy story of a restaurant owner’s tax fraud scandal. Texas tax pros, IRSProb, serve up the details.

Discover how an employee’s hidden harvest led to a whopping $14M blow. A must-read tax cautionary tale from IRSProb, your tax relief experts.

Navigate capital loss claims like a pro. IRSProb provides savvy guidance on tax returns, easing your IRS woes. Texas tax relief made easy.

Get expert guidance to navigate tax liens, IRS audits, and more. Discover how to choose the perfect tax professional for your business at IRSProb.

Boost your savings and reduce tax liabilities with a Health Savings Account. Learn more at IRSProb, your Texas tax relief experts.

Discover how the IRS is upping its customer service game with thousands of new hires, ready to tackle your tax troubles at IRSProb.com.

Discover how a business owner earned a 3-year stint behind bars for neglecting employment taxes. A cautionary tale from IRSProb, your tax relief specialists.

Discover how even law professionals fall prey to tax charges! Visit IRSProb to understand & avoid such pitfalls.

Explore how the new congress impacts your taxes with IRSProb, your Texas tax relief experts. Stay updated, stay prepared!

Unearth the intriguing tale of a man’s tax evasion trial and its verdict. IRSProb, your Texas tax relief expert, breaks it down.

Kick off 2023 with IRSProb’s latest tax relief tips & IRS audit insights. Navigate tax liens like a pro with our January newsletter!

Navigate the complexities of IRS Letter 1058 with IRSProb, Texas’ tax relief specialists. Understand your rights and avoid levies.

Sausage shop owner gets grilled in a tax evasion case, lands a year in prison. Learn how IRSProb can help you avoid such a tax pickle.

Navigate the IRS LT11 Collections maze with ease. IRSProb, your Texas tax relief experts, decode this daunting notice for you.

Unearth the story of a Texas landscape company owner bracing for 60 months due to IRS issues. Real life tax drama at IRSProb!

Discover how our passion for tax relief became your solution to IRS woes. IRSProb, your Texas-based guide through tax liens and audits.

Fall prey to tax evasion? Not on our watch! Read how a Texas man lands 18-month sentence. Nip your IRS worries in the bud with IRSProb.

Dive into the tale of a Las Vegas tax preparer whose high-stakes gamble with the IRS didn’t pay off. Learn from their mistakes with IRSProb.

Explore how IRSProb proposes a budget revamp and funding boost to modernize IRS IT and enhance taxpayer services. Dive in!

Celebrate with IRSProb as we bag our first win of 2023, providing top-notch tax relief to Texans. Discover the victory story here!

Fortune teller’s future didn’t foresee IRS audits! Uncover this tale of stolen fortunes, tax evasion, and poetic justice at IRSProb.

Discover how Detroit’s ex-mayor landed in hot water with the IRS. Unravel the tale of tax evasion, debt, and IRS audits at IRSProb.

Owe back taxes? Don’t panic! Discover strategic solutions with IRSProb, your Texas tax relief experts tackling tax liens and IRS audits.

Discover IRSProb’s insights on the growing US tax gap. We offer expert tax relief services to help you navigate the complexities of the IRS.

Discover the ins and outs of tax filing when you owe money. IRSProb, your Texas tax relief experts, guide you through liens, audits, and more.

Discover how taxpayer advocates fall short in IRS battles, leaving clients stranded. Get expert tax relief with IRSProb, your Texas ally in tax woes.

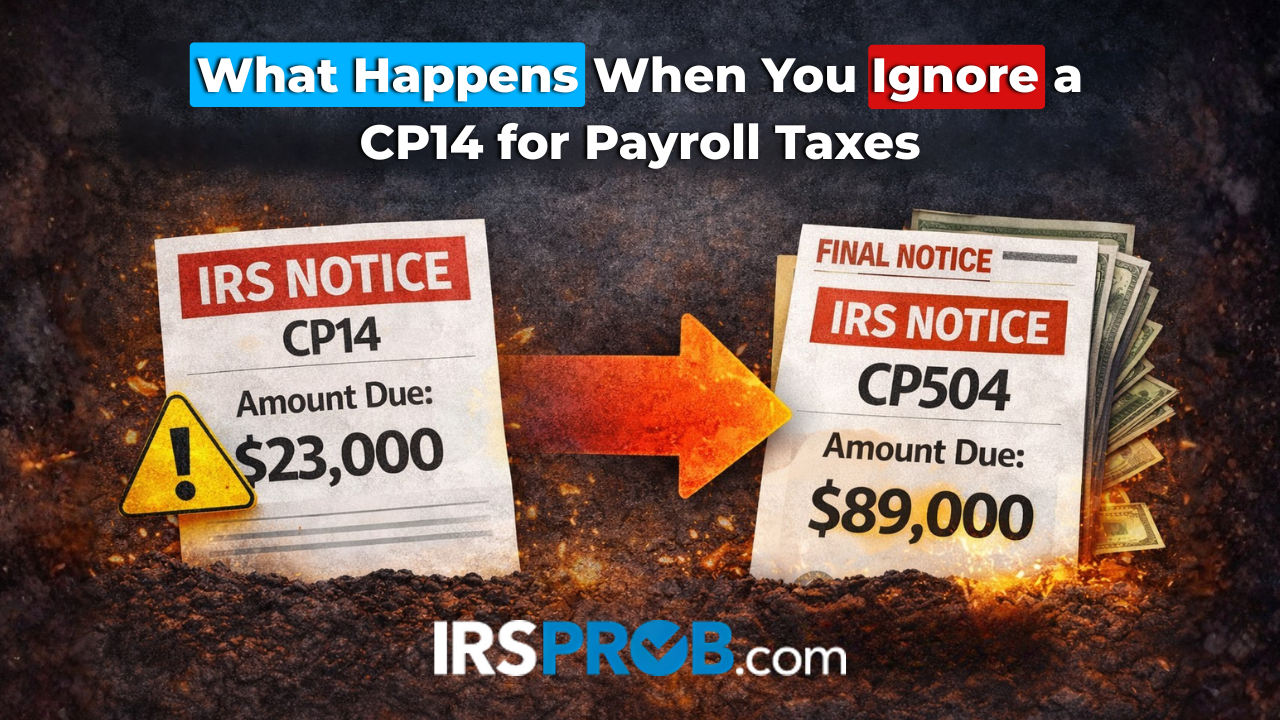

Facing an IRS CP504 Collections Notice? IRSProb clarifies this tax hurdle and guides Texans towards smart, savvy tax relief solutions.

Delve into IRSProb’s analysis on the pending Senate confirmation of the new IRS Commissioner. Tax relief expertise included!

Discover IRSProb’s expert take on the Supreme Court hearing a case on IRS summons use. Navigate the tax maze with us!

Explore how Trump’s tax return impacts precedents. IRSProb, your Texas tax relief experts, unpack the implications for audits, liens, and more.

Struggling with IRS issues? Navigate IRSProb’s guide to pick a competent tax pro and turn your tax worries into relief. Texas tax experts at your service!

Unravel the mystery of cryptocurrency taxation with IRSProb’s expert guide. Navigate Bitcoin, Ether & more with us. Max 150 characters of crypto clarity!

Apple’s own falls prey to temptation. Unearths a $17M fraudulent scheme. Learn more about this juicy scandal’s tax implications at IRSProb.

Discover how a Canadian tried to outfox the IRS! Read about this audacious attempt at tax fraud at IRSProb, your tax relief experts.

Discover how an accountant’s clever scheme to have his employer pay his bills caught IRS’ attention. Get insights on tax ethics on IRSProb.

Discover how an electrical engineer faces up to five years in jail for tax evasion. A shocking case study from the tax relief experts at IRSProb.

IRSProb updates: IRS postpones cryptocurrency reporting. Stay ahead with Texas’ top tax relief experts. Navigate crypto tax waters with us.

Caught in a tax trap? Even elected officials aren’t immune. Discover this intriguing tax evasion case on IRSProb – your Texas tax relief experts.

Tax relief gone wrong – read how a man faces 40 months for short-changing Uncle Sam on a $1.8M tax bill at IRSProb.com. Don’t be next!

Breathe easy, side-giggers! IRSProb reveals IRS delays in auditing your gig income. Discover more on our Texas tax relief services.

Stay updated with IRSProb! IRS delays new $600+ side hustle filing rules. Get the scoop on tax relief & IRS audits in Texas.

Discover how famed bounty hunter Dog has found himself in IRS crosshairs owing millions. A captivating tale of tax woes at IRSProb.com.

Dive into IRSProb’s analysis on why the IRS couldn’t finish Trump’s audit. Tax relief insights from the heart of Texas, served with a side of wit!

Explore how billionaire Ken Griffin takes on the IRS in court. Unravel the intriguing tax battle at IRSProb – your tax relief specialists.

Explore IRSProb’s insights on potential IRS improvements in 2023. Uncover tax relief strategies from our Texas-based experts.

Minnesota’s tax guru faces irony of justice, as he pleads guilty to tax evasion. A lesson in why even tax pros need experts like IRSProb.

Avoid a holiday nightmare with IRSProb’s guidance on IRS Christmas Paycheck Levy. Navigate tax relief and liens confidently this festive season.

Find relief with IRSProb, your Texas tax experts! Discover how to settle IRS debt for less than you owe. Learn more at our link.

When a daycare owner dodges taxes, it’s not child’s play. Dive into this cautionary tale from IRSProb, your Texas tax relief experts.

Uncover the intriguing story of a man’s brush with tax law and his subsequent probation. IRSProb, your guide in tax relief complexities.

Trouble with the taxman? Learn from a Texas woman’s 33-month jail saga on IRSProb. Avoid IRS woes with our expert tax relief solutions.

Discover how a Texas dentist’s golden smile turned into grimace after losing a tax evasion case. Don’t let it be you, get expert tax help at IRSProb.

Discover how an Illinois man’s 48 phony W-2s landed him behind bars. A stark reminder from IRSProb – play fair with your taxes!

Discover how a Homeowner’s Association Finance Manager’s swift descent into fraud led to a 37-month jail term. A cautionary tale from IRSProb.

Delve into the tale of an Alaskan tax dodger facing severe consequences. Discover IRSProb’s expertise in tax relief and IRS audits.

Unlock the mystery of federal tax liens with IRSProb’s Q&A guide. Learn, understand and conquer your IRS woes today. Texas tax relief expertise at your service.

Convicted accountant learns the hard way that tax evasion doesn’t pay! Discover the $1M+ payroll tax fiasco at IRSProb.com.

Explore IRSProb’s insights on whether to issue your child a W-2 or 1099 when paying them. Learn how to navigate tax laws and save money!

Discover IRSProb’s insights on the new 62.5 mileage rate. Expert Texas-based tax relief advice to drive your savings up a gear!

Navigate the complexities of self-employment taxes as a partner or LLC member with IRSProb – your trusted Texas tax relief specialists.

Get to grips with Self-Employment Tax Basics at IRSProb – your Texas tax relief specialist. Navigate tax liens and IRS audits with ease.

Navigate the tricky terrain of tax laws on legal fees with IRSProb, your Texas tax relief experts. Get savvy, get sorted!

Facing IRS troubles? Get expert advice from IRSProb on how to legally take the IRS to court. Less fear, more facts – right here in Texas!

Appreciating your visit at IRSProb, we’re all set to tackle your tax woes in Texas. Expect relief from liens and audits soon!

Explore how acquisitions can lead to payroll tax discounts at IRSProb. Save smart, stay compliant, and discover tax relief solutions in Texas.

Swap your vacation home tax-free! Discover expert strategies from IRSProb, your trusted Texas tax relief specialists. Learn more today!

Secure your future with IRSProb. Learn how to safeguard your life insurance proceeds from taxes. Texas-based tax relief expertise at your service.

Navigate the tax relief maze with IRSProb, Texas’ top professionals. Discover tips for hiring experts for tax liens and IRS audits on our page.

Boost your business prowess with IRSProb. Learn strategies to stay active in managing tax liens, IRS audits, and achieving tax relief.

Get expert answers to your IRS queries at IRSProb! Explore our Texas tax relief services including IRS audits, tax liens. Click, learn and relax!

Discover how one family’s tax fraud landed them in jail, and learn how IRSProb can help you avoid such mistakes. Stay tax-legal, Texas!

Discover smart tax relief strategies with IRSProb. Explore how taking tax shelter can protect your income and assets from tax liens and IRS audits.

Drive your way to tax relief with IRSProb’s expert guide on tax mileage. Learn how to turn miles into savings! Visit us now.

Learn how taxes impact you with IRSProb, your Texas tax relief expert. Unravel tax liens, IRS audits, and find the relief you need.

Stressed about owing the IRS? IRSProb, a Texas tax relief expert, can help you navigate liens, audits, and ease your tax woes. Visit us now!

Discover how a registered nurse traded scrubs for stripes due to tax fraud. Stay informed, avoid similar pitfalls with IRSProb’s expert guidance.

Unlock tax-free growth with a Roth conversion. Discover how IRSProb, Texas’ tax relief experts, can guide your transition. Visit our page now!

Struggling with a hefty tax debt? Discover savvy strategies to negotiate with IRS, reduce liabilities, & regain control at IRSProb.

Delve into a case where crafty crime concealment led to increased jail time! IRSProb sheds light on the repercussions.

Avoid falling into common business pitfalls with IRSProb’s expert tax relief advice. Click to learn, adapt and stay IRS compliant. Texas’ finest!

Explore top health deductions for solo C Corporation owners. IRSProb offers expert advice to maximize your tax relief. Navigate your IRS issues with us.

Navigate tricky tax waters with ease! Discover if your daughter’s income should be filed under W-2 or 1099. Expert advice from IRSProb awaits.

Navigate the new 62.5 cents mileage rate with ease! Get expert advice from IRSProb, your trusted Texas tax relief company.

Learn how to minimize employment taxes using the S Corporation strategy. Expert advice from Texas’s leading tax relief specialists at IRSProb.

Master the tax maze of self-employment with IRSProb. Navigate tax issues, save more, and grow your business effortlessly. Click, learn, and prosper!

Avoid tax trouble! Learn the consequences LLC members and partners face when they skip self-employment taxes. Click to understand better!

Uncover hidden taxes lurking in your C Corporation. IRSProb, your Texas tax relief guide, reveals all. Dive in now!

Uncover how the DOL awarded $39K to workers due to an employer’s illicit tip pool tactics. Learn more with IRSProb, your tax relief ally.

Discover 9 tax benefits for volunteering your time & resources to charities. Let IRSProb, Texas’ tax relief experts, guide your way to savings!

Discover how IRSProb is leveraging the IRS’ expanded voice bot options to provide faster, smarter tax relief solutions in Texas.

Supreme Court eyes penalties for undisclosed foreign accounts – an IRSProb analysis. Tax relief just got more intriguing in Texas!

Unleash the details of IRS going beast mode! Get expert guidance on tax relief, IRS audits, and tax liens at IRSProb, your Texas tax relief ally.

Unravel the mystery of Child Tax Credit (CTC) entitlement with IRSProb, your trusted Texas tax relief specialists. Click, learn, and conquer your taxes!

Discover why there’s no such thing as absolute audit protection and how IRSProb, a Texas tax relief specialist, can help you navigate IRS audits and tax liens.

Find your tax haven! Explore IRSProb’s guide on states with the most lenient tax policies. Never fear tax season again!

Explore the benefits of cement tax breaks for sale-leaseback deals with IRSProb, your Texas tax relief ally. Don’t let IRS audits brick your progress!

Discover if your hobby earnings are taxable with IRSProb, your Texas tax relief specialists. Unravel tax liens, audits & more. Learn now!

Navigate the road of luxury car taxes with IRSProb. Discover savvy strategies to avoid potential IRS pitfalls. Texas tax relief, redefined.

Discover how mixing family and finance can benefit both your child’s future and your tax relief strategy this summer at IRSProb, Texas’ tax specialists.

Discover how trimming payroll tax for shared workers can benefit your business. Expert advice from Texas’s leading tax relief specialists at IRSProb.

Avoid hefty fines with IRSProb! Navigate tax pitfalls with our guide on 4 major tax penalties and stay clear of IRS troubles.

Explore the possibilities of Bitcoin donations and its tax implications on IRSProb. A guide to navigating crypto-charity, tax benefits & more!

Maximize your tax savings with IRSProb’s guide on expanding home office deductions. Texas’ finest in tax relief services!

Discover who owes self-employment taxes and why with IRSProb, your Texas tax relief specialist. Unravel the IRS mystery today!

Navigate the international tax maze with IRSProb. Expert advice on foreign tax laws, audits, and liens to save you from IRS headaches.

Make your Saturdays great again with IRSProb, your Texas tax relief specialist. Say goodbye to tax liens and IRS audits!

Discover ways to curb your gambling loss deductions with IRSProb, your Texas tax relief expert, and keep your finances in check!

Master the art of tackling IRS letters with IRSProb. Learn how our Texas-based tax relief experts can help you navigate tax liens and audits.

Explore your final opportunities for Roth IRA contributions at IRSProb, Texas’ leading tax relief experts. Act now, time is ticking!

Explore IRSProb’s guide on tax breaks for fundraisers. Uncover tips to maximize relief, handle tax liens and navigate IRS audits. Texas tax woes? We’ve got solutions!

Swap stress for serenity! Learn how moving abroad impacts your US taxes with IRSProb – your Texas tax relief specialists.

Discover overlooked child credits that could save you big on taxes. Explore IRSProb’s expert advice on child tax benefits now!

Discover the tax implications of travel for temporary jobs with IRSProb. Unravel the IRS mysteries on the go, Texas style!

Learn to make savvy tax decisions for I bonds. IRSProb, your Texas tax relief pro, guides you through IRS audits, tax liens, and more.

Learn how an Iowa man faced IRS wrath for dodging tax returns. A cautionary tale brought to you by IRSProb – your tax relief experts.

Boston’s finest in hot water! A local cop admits guilt in tax fraud case. Dive into the details with IRSProb, your tax relief experts.

Discover the 5 tax breaks bidding goodbye on IRSProb. Stay updated, plan wisely & navigate your taxes efficiently with our Texas experts!

Unearth the Superintendent’s tax concealment saga from the BOE. Get the scoop now with IRSProb, your Texas tax relief expert.

Discover how a man’s failure to play by IRS rules lands him a 3-year prison sentence and a $40M bill. Dive into the story at IRSProb.

Explore tax credits for your student spouse with IRSProb, your Texas tax relief ally. Navigate IRS audits and liens, smarter!

Unearth the riveting tale of an Iowa woman’s brush with tax evasion. Dive into the IRSProb’s expert insight on potential penalties.

Navigate the digital tax labyrinth with ease! IRSProb offers savvy solutions to prevent tax pitfalls for your computers. Texas-based tax relief at its best.

Discover how a Lowe’s affiliate got tangled in a $13.1M federal tax lien. IRSProb unpacks the story, offering expert tax relief insights.

Facing an IRS tax lien? Don’t panic! Visit IRSProb for expert advice on navigating tax issues & resolving your predicament. Your peace of mind is our priority!

Unearth the tale of a former FEMA worker crossing paths with IRS trouble. Your go-to for tax relief insights in Texas.

Outsource your payroll confidently with IRSProb’s guide! Ensure tax compliance and avoid pitfalls with our expert tips on payroll outsourcing rules.

Dive into this gripping tale of a dentist couple entangled in tax woes. Discover how IRSProb, the tax relief experts, came to their rescue.

Discover how a North Dakota State Senate candidate’s IRS tax liens might impact his campaign. Expert analysis from IRSProb, your tax relief specialists.

Unlock tax relief secrets for your condo or co-op with IRSProb. Explore ways to maximize deductions and minimize IRS hassles. Texas tax pros at your service!

Learn how the IRS means business with ‘The Buck Stops Here.’ Unravel tax relief, IRS audits, and tax liens with Texas-based IRSProb.

Discover how to serve up sweet tax savings with IRSProb’s guide on cafeteria plan perks. Get the dish on smart tax relief in Texas!

Discover how a law enforcer turned law breaker, swindled investors. IRSProb unravels this tax fraud tale, reminding you why professional tax help matters.

Discover how a Stanford University staff member faced tax woes, adding a new twist to the phrase ‘academic failure’. Explore the story on IRSProb.

Avoid penalties on early 529 plan withdrawals. Expert tips from IRSProb, your Texas tax relief specialists. Learn more!

Uncover the tale of a Virginia man’s journey into the murky waters of false tax returns. A cautionary tale from IRSProb, your tax relief experts.

Discover how two Florida women landed behind bars for a whopping $25M tax fraud plot. A cautionary tale from IRSProb – your tax relief experts.

Navigate the tax maze with IRSProb! Discover how our Texas experts can help you secure an 80% IRS audit reduction. Visit now!

Discover how an RV salesman’s detour into tax evasion led him to a dead-end with the IRS. Uncover the tale at IRSProb.

Unlock the secrets of home sale exclusion with IRSProb, your Texas tax relief experts. Navigate tax liens and audits like a pro!

Discover how IRSProb, a Texas-based tax relief expert, can help you tackle tax liens and IRS audits. Time to say Mo’ money, less problems!

Dive into this tale of a fisherman facing a 15-year stay in the slammer for neglecting a whopping $2.7M in payroll taxes. Hooked yet?

Unravel the mystery of math errors in your taxes with IRSProb, your Texas tax relief expert. Say goodbye to tax liens and IRS audits today!

Get your engines running with IRSProb! Navigate through tax relief, liens, IRS audits like a pro. Fuel up at https://irsprob.com/all-revved-up/

Discover how the IRS tapped into a goldmine of $245M in 2021, thanks to whistleblowers. Unearthed at IRSProb, your tax relief experts.

Dive into Salter’s tax court case, TC Memo 2022-29. Learn the ins and outs of this IRS ruling and how it impacts tax relief strategies.

Navigate the complexities of gambling loss deductions with IRSProb. Turn your losses into wins with smart tax strategies. Texas tax relief made easy.

Discover how an approved IRS offer in compromise impacts your tax lien. Unravel tax relief mysteries with IRSProb, your Texas tax experts.

Explore the ins and outs of Limited Liability Companies at IRSProb. Texas tax relief experts unpack LLCs, tax implications, and more.

Explore Part 2 of our deep dive into self-directed IRAs for real estate. Uncover the perks and pitfalls with IRSProb, your tax relief experts.

Traveling to Mexico by cruise ship? IRSProb reveals how your trip could be tax-deductible. Sail your way to tax relief today!