Free consultation available. Call 214-214-3000 today!

The email from your mortgage lender had three words in the subject line: "Application Status: Denied."

You were preapproved last month. Nothing changed. Same job. Same income. Same down payment saved.

Then you see the reason buried in paragraph three: "Public record filing identified during underwriting review."

Public record? You've never been arrested. Never been sued. Never filed bankruptcy.

You pull your credit report and there it is, black and white: Federal Tax Lien.

Your score dropped from 720 to 580 overnight.

The mortgage you needed? Gone. The house your kids were excited about? Someone else is buying it. All because the IRS filed a public document you didn't even know existed.

Here's what that lien actually does, and how to remove it before it destroys anything else.

What Is a Federal Tax Lien (And Why Is It Destroying Your Credit)?

A federal tax lien is the government's legal claim against everything you own when you don't pay tax liability.

Think of it like this: You owe the IRS money. They sent you notices. You ignored them or couldn't pay. So they filed a public document that says "This person owes us money, and we have first claim to everything they own."

The IRS doesn't file liens on day one. There's a process.

Here's what probably happened:

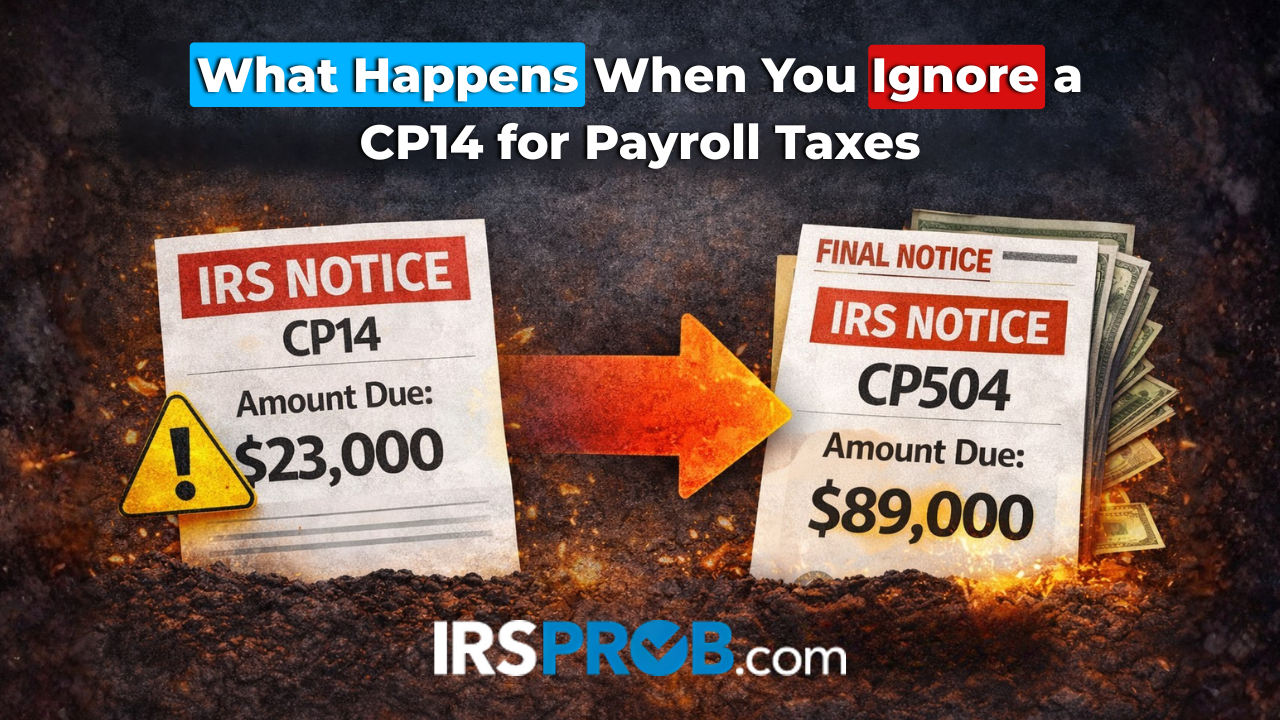

First, you got a bill showing what you owed (Notice CP14). Most people ignore this one.

Second, you got a reminder (Notice CP501). Still ignored.

Third, you got a final notice before collection action (Notice CP503 or CP504). These look like the earlier letters, so people keep ignoring them.

Fourth, the IRS filed a Notice of Federal Tax Lien with your county recorder's office. Now it's public record.

By the time you discovered that federal tax lien credit score damage, the lien had been public for weeks or months. You just didn't know until someone checking your credit found it.

And that's when everything started falling apart.

What Does a Federal Tax Lien Actually Attach To?

This is the part that shocks people.

A federal tax lien doesn't just attach to one thing. It attaches to everything you currently own and everything you'll acquire while the lien exists.

That includes:

Your house. Your car. Your bank accounts. Your investment accounts. Your business equipment. Money people owe you. Even inheritance you receive while the lien is active.

If you own it, or will own it, the IRS has a claim to it.

The lien also gives the IRS priority over almost every other creditor. If you sell your house, the IRS gets paid before your mortgage lender gets paid. Before anyone else gets paid.

This is why mortgage companies won't touch you with a federal tax lien on your record. They're not getting first position anymore. The IRS is.

The Real Damage: What Happens to Your Federal Tax Lien Credit Score

Let's talk about what this actually costs you.

Your Credit Score Tanks

Before 2018, tax liens stayed on credit reports for seven to ten years. The three major credit bureaus (Equifax, Experian, TransUnion) removed tax liens from reports in 2018 as part of a settlement.

But here's what people miss: lenders still check public records.

When you apply for a mortgage, car loan, or business credit, underwriters pull your credit report AND search public records. That lien shows up anyway.

Even without appearing directly on your credit report, the federal tax lien credit score impact is severe because:

- Mortgage lenders auto-deny applications with active liens

- Auto lenders see you as high-risk and jack up interest rates (if they approve you at all)

- Credit card companies lower your limits or close accounts

- Landlords reject rental applications

- Some employers (especially in finance, government, or positions requiring security clearance) won't hire you

You Can't Refinance Anything

That mortgage refinance you were counting on to lower your payment? Not happening with a lien.

That car refinance to reduce your monthly burden? Rejected.

Any loan that requires a lien position check will fail as long as the IRS has first claim.

You Can't Sell Property Easily

Want to sell your house and move? The IRS gets paid first from the proceeds. If there's not enough equity to pay them, they might not release the lien at all.

Most buyers won't touch a property with a tax lien attached. Their title company won't insure it. Their lender won't fund it.

You're stuck until you deal with the lien.

Employment Problems

If you work in finance, accounting, government, or need security clearance, a federal tax lien can cost you your job or block promotions.

Employers in these fields run background checks that include public record searches. When they find a tax lien, it raises questions about financial responsibility and trustworthiness.

I've seen people lose job offers two weeks before their start date because a lien appeared during final verification.

How Long Does This Nightmare Last?

A federal tax lien stays in public records until one of three things happens:

Option 1: You pay the tax debt in full. The IRS issues a Certificate of Release within 30 days. The lien is removed from public record.

Option 2: The IRS withdraws the lien. This is different from release. Withdrawal removes the public Notice of Federal Tax Lien like it never existed. You can request lien withdrawal if you pay the debt, set up a Direct Debit Installment Agreement, or qualify under the IRS Fresh Start program.

Option 3: The collection statute expires. The IRS generally has 10 years to collect tax debt. If the Collection Statute Expiration Date (CSED) passes, the lien is released. But this rarely happens because the IRS is aggressive about collection before time runs out.

Important: Even after the debt is paid and the lien is released, the public record of the lien filing can stay searchable for years. This is why lien withdrawal is better than lien release when possible.

Withdrawal erases the public Notice of Federal Tax Lien. Release just shows it was satisfied.

Three Ways to Remove a Federal Tax Lien (And Fix Your Credit)

Let's get to solutions. You have three main paths to remove a federal tax lien and stop the bleeding on your credit and financial life.

Method #1: Pay the Tax Debt in Full and Request Certificate of Release

How it works: Pay the full amount owed. The IRS issues a Certificate of Release of Federal Tax Lien within 30 days.

Reality check: Most people with liens can't just write a check for $30,000 or $80,000. If you could, you probably would've paid it already.

But if you're getting a windfall—inheritance, lawsuit settlement, business sale—paying in full is the fastest way to clear the lien.

Next step after paying: Request lien withdrawal (not just release). IRS Form 12277 lets you apply for withdrawal, which removes the public filing entirely. This is much better for your federal tax lien credit score recovery than just getting a release.

Method #2: Lien Withdrawal with Direct Debit Installment Agreement

How it works: Set up a payment plan with the IRS using Direct Debit (automatic bank withdrawals). After you make three consecutive on-time payments, you can request lien withdrawal.

Who qualifies: You need to:

- Owe $25,000 or less in combined tax, penalties, and interest

- Set up a Direct Debit Installment Agreement (DDIA)

- Make three consecutive monthly payments

- Request withdrawal using Form 12277

Why this works: The IRS gets guaranteed monthly payments. You get the public lien removed. Your federal tax lien credit score damage stops getting worse.

Important: The debt isn't forgiven. You still owe it. But the public Notice of Federal Tax Lien is withdrawn, which means lenders and employers won't see it in public record searches anymore.

This is the most realistic option for most people.

Learn more about setting up an IRS installment agreement.

Method #3: Lien Discharge or Subordination for Specific Property

Sometimes you need to sell property or refinance, but the lien is blocking it. The IRS has two tools for this:

Discharge: Removes the lien from a specific property. You'd use this when selling a house. The IRS gets paid from the sale proceeds, and they release their claim on that property specifically.

Subordination: Allows another creditor (like a mortgage lender) to move ahead of the IRS in lien priority. This is used for refinancing. The IRS isn't releasing the lien, just letting someone else go first.

Why you'd need this: You're selling your house to pay off the IRS, or you're refinancing to get cash to pay the IRS, but the lien is blocking the transaction.

You apply using Form 14135 (for discharge) or Form 14134 (for subordination).

Reality check: The IRS has to approve these. They'll only say yes if they believe they'll get their money. If you're selling a house for $200,000 and owe the IRS $50,000, they'll likely approve discharge because they're getting paid. If you're trying to refinance with no clear benefit to the IRS, they'll say no.

What to Do Right Now If You Have a Federal Tax Lien

First, don't panic. I know seeing that federal tax lien credit score drop feels like the end, but liens are fixable.

Step 1: Get your IRS Account Transcript. Call 800-829-1040 or request it online. You need to see exactly what you owe and when the lien was filed.

Step 2: Check if you qualify for lien withdrawal through Direct Debit Installment Agreement. If you owe $25,000 or less, this is your fastest path.

Step 3: If you owe more than $25,000, you have options: standard installment agreement, Offer in Compromise (settle for less), or Currently Not Collectible status if you're in genuine financial hardship.

Step 4: Request lien withdrawal as soon as you're eligible. Don't just accept a release. Withdrawal removes the public filing entirely.

Step 5: If you're trying to buy a house, refinance, or get a job and the lien is blocking it, talk to a tax professional about discharge or subordination options.

The key is acting now. The longer a federal tax lien sits in public record, the more damage it does to your financial life.

Get Professional Help Removing Your Federal Tax Lien

At IRSProb.com, we've helped hundreds of people remove federal tax liens and repair the credit damage.

We handle:

- Lien withdrawal applications

- Direct Debit Installment Agreement setup

- Lien discharge for property sales

- Lien subordination for refinancing

- Offer in Compromise if you qualify to settle for less

- Currently Not Collectible applications

We know exactly what the IRS requires, and we know how to get liens removed fast.

Don't let a federal tax lien destroy your mortgage approval, your job opportunity, or your financial future.

📞 Call 214-214-3000 for a free consultation.

We'll review your situation, explain your options, and create a plan to remove that lien and stop the credit damage.

The IRS filed that lien to scare you into action. Let's use that action to make it disappear.

🔗 Visit irsprob.com

📧 Schedule online for your consultation