Free consultation available. Call 214-214-3000 today!

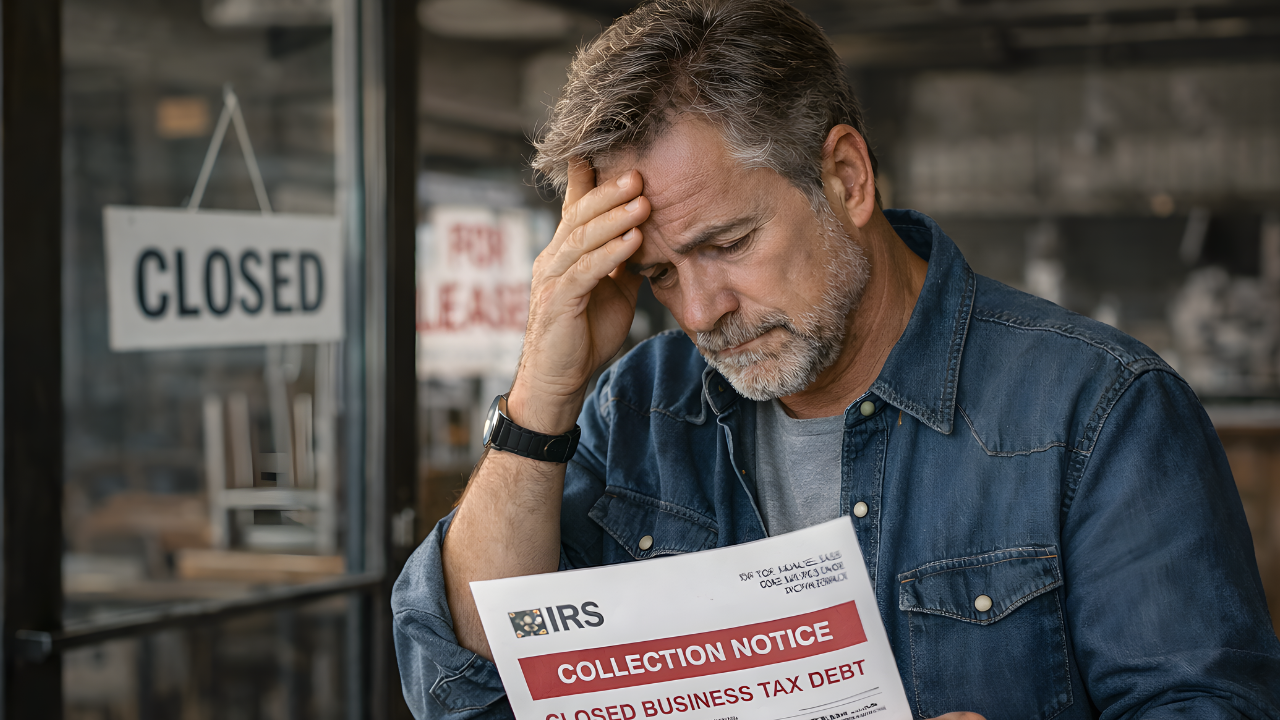

You closed your business. Maybe it was planned, maybe it wasn't. Perhaps the market shifted, funding dried up, or life just happened. Either way, the LLC is dissolved, the doors are locked, and you're ready to move on.

Quick Navigation - Jump to Any Section

Except there's one problem: you still owe business taxes.

And now you're discovering what thousands of former business owners learn the hard way: closing your business doesn't make the tax debt disappear. The IRS doesn't care that your company no longer operates. They want their money, and depending on how your business was structured and what type of taxes you owe, they might be coming after you personally.

This is one of the most stressful situations a business owner can face. You already dealt with the emotional and financial toll of closing your business. Now you're dealing with collection notices, threats of liens and levies, and the terrifying realization that your personal assets might be at risk.

But here's what you need to know right now: you have options. The closed business tax debt is real, but it's manageable. Understanding what you're actually liable for and what steps to take next can mean the difference between financial disaster and a workable resolution.

Let's break down everything you need to know about closed business tax debt.

The Harsh Truth: Closing Your Business Doesn't Erase Tax Debt

First, let's address the elephant in the room.

Many business owners assume that when they dissolve their LLC, close their S-Corp, or shut down their sole proprietorship, the tax debt goes away with it. After all, the business no longer exists, right?

Wrong.

Tax debt doesn't vanish when you file dissolution paperwork with your state. The IRS doesn't care that your business isn't operating anymore. From their perspective, the tax liability was created while the business was active, and someone needs to pay it.

The question isn't whether the debt exists. The question is who's responsible for paying it.

And that answer depends on three critical factors:

- How your business was structured (LLC, S-Corp, C-Corp, sole proprietorship, partnership)

- What type of taxes you owe (income tax, payroll tax, sales tax, etc.)

- Whether you took certain actions that made you personally liable

Let's examine each of these factors in detail.

Does Your Business Structure Protect You From Personal Liability?

One of the main reasons people form LLCs and corporations is to create a legal separation between business debts and personal assets. This protection works for most types of debt, but business tax debt operates under different rules.

Sole Proprietorship

If you operated as a sole proprietor (no LLC, no corporation, just you doing business), there's no separation between business and personal. Business tax debt is automatically personal tax debt. The IRS can pursue your personal assets, levy your bank accounts, garnish your wages, and place liens on your property.

There's no protection here. The business was you, the debt is yours.

Single Member LLC

Here's where it gets tricky. Many solo entrepreneurs form single member LLCs thinking they're protected. And for most debts, you are.

But for federal tax purposes, the IRS treats single member LLCs as disregarded entities by default. That means for tax purposes, the LLC doesn't exist. The IRS sees it as a sole proprietorship.

Result: You're personally liable for business income taxes from a single member LLC, just as if you'd operated as a sole proprietor. The LLC structure doesn't protect you from closed business tax debt for income taxes.

Multi-Member LLC (Partnership)

If your LLC had multiple members, it's treated as a partnership for tax purposes. Partnerships don't pay federal income tax themselves. Instead, profits and losses pass through to the partners, who report them on their personal returns.

If the partnership owes taxes, each partner is jointly and severally liable for the entire debt. That means the IRS can collect the full amount from any partner, not just their proportional share.

So if you were one of three equal partners and the partnership owes $90,000, the IRS can collect the entire $90,000 from you personally if they choose. You'd then have to seek reimbursement from the other partners (good luck with that after the business is closed).

S-Corporation

S-Corps also pass income through to shareholders. Like partnerships, the corporation doesn't pay federal income tax at the corporate level (with some exceptions).

Shareholders are generally not personally liable for corporate income tax debts. The corporation is a separate legal entity, and if it owes taxes, those are the corporation's debts.

However, there are massive exceptions we'll discuss in the payroll tax section below. If you were an officer or responsible party for an S-Corp and didn't pay over employment taxes, you can be held personally liable regardless of the corporate structure.

C-Corporation

Traditional C-Corps are taxed separately from their owners. If a C-Corp owes corporate income taxes, shareholders are generally not personally liable.

Again, the major exception is payroll taxes, which we're about to discuss.

Comparison Table: Entity Type and Tax Liability

| Business Structure | Personal Liability for Income Tax? | Personal Liability for Payroll Tax? |

|---|---|---|

| Sole Proprietorship | Yes (automatic) | Yes (if you had employees) |

| Single-Member LLC | Yes (disregarded entity) | Yes (if you were responsible party) |

| Multi-Member LLC | Yes (joint and several) | Yes (if you were responsible party) |

| S-Corporation | Generally No | Yes (if you were responsible party) |

| C-Corporation | Generally No | Yes (if you were responsible party) |

Your business structure might protect you from income tax liability, but it almost never protects you from payroll tax liability if you were a responsible party.

The Trust Fund Recovery Penalty: Why Payroll Taxes Are Different

If your business had employees and you're dealing with unpaid payroll taxes, pay very close attention to this section. This is where many former business owners get blindsided.

Payroll taxes are different from all other business taxes. When your business withheld federal income tax, Social Security tax, and Medicare tax from employee paychecks, that money didn't belong to your business. It belonged to the employees and the government. Your business was merely holding it "in trust" until it was supposed to be paid over to the IRS.

If your business failed to pay over those withheld taxes, the IRS views this as theft from employees and the government. As a result, they have a special weapon: the Trust Fund Recovery Penalty (TFRP).

What Is the Trust Fund Recovery Penalty?

The TFRP allows the IRS to hold individuals personally responsible for unpaid employment taxes, even if the business was an LLC or corporation. The penalty equals 100% of the unpaid trust fund taxes (the employee withholding portion, not the employer matching portion).

If your business withheld $50,000 from employee paychecks and didn't pay it to the IRS, the IRS can assess a $50,000 penalty against you personally.

Who Can Be Hit with the TFRP?

The IRS can assess the TFRP against any "responsible person" who "willfully" failed to pay over the taxes. This sounds technical, but in practice, it includes:

- Business owners

- Corporate officers

- Partners

- LLC members who made financial decisions

- Anyone who had authority to sign checks or make payments

- Anyone who made decisions about which creditors to pay

"Willfully" doesn't mean you intended to defraud the government. It simply means you knew (or should have known) the taxes weren't being paid and you had the authority to pay them but didn't.

If you paid other creditors while leaving payroll taxes unpaid, that's willful failure in the IRS's eyes.

The TFRP Doesn't Go Away

This penalty is not dischargeable in bankruptcy. It survives even after your business is closed. And the IRS is extremely aggressive about collecting it.

CRITICAL: If you're facing a potential TFRP assessment, this is not a DIY situation. You need professional representation immediately.

What Happens to Business Tax Debt After You Close?

So your business is closed, and there's tax debt. What actually happens next?

The IRS Doesn't Stop Collecting

Just because your business shut down doesn't mean the IRS stops trying to collect. They'll continue sending notices. They'll assess penalties and interest. They'll file liens. They'll pursue collection actions.

If the debt is business income tax and you're not personally liable (rare situations with corporations), the IRS will pursue the business entity's assets. If the business has been dissolved and has no assets, they may eventually write off the debt as uncollectible.

But if you're personally liable (which is the case for most closed business tax debt situations), the IRS will come after you.

Personal Assets at Risk

When you're personally liable for closed business tax debt, the IRS can:

- Place liens on your personal property (home, vehicles, etc.)

- Levy your personal bank accounts

- Garnish your wages from your new job

- Seize other personal assets

- Revoke your passport if you owe more than $62,000

The business being closed doesn't protect your personal assets when you're personally liable.

The Collection Statute Still Applies

The IRS has 10 years from the date they assess the tax to collect it. This is called the Collection Statute Expiration Date (CSED).

When a business closes, the clock doesn't restart. If the tax was assessed 3 years ago, the IRS has 7 years left to collect.

However, certain actions can extend or suspend the collection statute, including filing an Offer in Compromise, declaring bankruptcy, or leaving the country for extended periods.

Your Options When You Owe Closed Business Tax Debt

Now for the important part: what can you actually do about this?

Option 1: Pay in Full

If you have the means to pay the debt in full, this is the cleanest solution. The debt is resolved, collection actions stop, and you can move forward.

Many former business owners have assets they can liquidate (retirement accounts, property equity, etc.) to satisfy the debt. Whether that's the right choice depends on your overall financial situation.

Option 2: Installment Agreement

If you can't pay in full but have steady income, you can set up a payment plan. The IRS offers installment agreements that let you pay over time (up to 72 months for individuals).

Your monthly payment depends on the total debt and your financial situation. For debts under $50,000, you can often set up an agreement without providing detailed financial information.

For larger debts, you'll need to submit financial statements showing your income, expenses, and assets. The IRS will calculate how much you can afford to pay monthly.

Option 3: Offer in Compromise

An Offer in Compromise (OIC) lets you settle the debt for less than the full amount owed. The IRS accepts offers when they determine you can't pay the full amount before the collection statute expires, or if paying the full amount would create economic hardship.

OICs are possible for closed business tax debt, but they're complex. You must prove you can't pay the full debt and that you're offering the maximum you can reasonably pay.

Success rates for DIY OIC applications are low (around 15%). Professional representation significantly increases approval rates.

Option 4: Currently Not Collectible Status

If you literally cannot afford to pay anything without sacrificing basic living expenses, the IRS can mark your account "Currently Not Collectible" (CNC).

During CNC status, collection actions stop. You don't make payments. However, interest and penalties continue accruing, and the debt doesn't go away. The IRS reviews your status periodically.

This is a temporary solution for genuine hardship situations. It provides breathing room while you get back on your feet.

Option 5: Bankruptcy

Some (but not all) business tax debt can be discharged in bankruptcy.

Requirements for tax debt to be dischargeable:

- The tax is from income taxes (not payroll taxes or fraud penalties)

- The tax return was due at least 3 years ago

- You filed the tax return at least 2 years ago

- The IRS assessed the tax at least 240 days ago

- The tax wasn't from fraud or willful evasion

Trust Fund Recovery Penalties are NOT dischargeable in bankruptcy. If you're facing TFRP assessments, bankruptcy won't help.

Option 6: Penalty Abatement

If your debt includes substantial penalties, you might be able to get them removed.

First-Time Penalty Abatement (FTA) removes failure-to-file and failure-to-pay penalties if you have a clean compliance history for the past three years.

Reasonable Cause abatement removes penalties if you can show circumstances beyond your control prevented timely payment (serious illness, natural disaster, etc.).

Penalty abatement doesn't reduce the tax owed or the interest, but removing penalties can significantly reduce your total debt.

Step-by-Step Action Plan for Closed Business Tax Debt

Here's exactly what to do if you're dealing with closed business tax debt:

Step 1: Determine What You Actually Owe

Request account transcripts from the IRS showing:

- Total tax liability

- Penalties and interest

- Payments already made

- Collection statute expiration date

You can request transcripts online, by phone (800-908-9946), or by mailing Form 4506-T.

Step 2: Confirm Your Personal Liability

Review your business structure and the type of taxes owed. Are you personally liable, or is the debt solely the business entity's obligation?

If you're uncertain, consult with a tax professional. This determination is critical to your strategy.

Step 3: Respond to IRS Notices Immediately

If you've received collection notices, don't ignore them. Each notice has a deadline. Missing deadlines limits your options and can result in liens, levies, or other aggressive collection actions.

Even if you can't pay, respond to the notice and request time to arrange payment or provide financial information.

Step 4: Gather Financial Documentation

Compile documentation of your current financial situation:

- Pay stubs or income statements

- Bank statements

- Monthly expense records

- Asset documentation (home value, vehicle equity, retirement accounts)

- Liability statements (mortgage, loans, credit cards)

Step 5: Explore Your Payment Options

Based on what you owe and your financial situation, determine which option makes sense:

- Can you pay in full or within 180 days?

- Can you afford monthly payments over 6 years?

- Is an Offer in Compromise realistic given your assets and income?

- Do you qualify for Currently Not Collectible status?

Step 6: Request Penalty Abatement

If you qualify for First-Time Penalty Abatement or have reasonable cause, request penalty removal before agreeing to a payment plan. This could reduce your debt by thousands or even tens of thousands of dollars.

Step 7: Set Up Your Resolution

Once you've determined the best approach, take action:

- Apply for an installment agreement online or by filing Form 9465

- Submit an Offer in Compromise with Form 656 and required financial statements

- Request Currently Not Collectible status by providing financial information

- Request penalty abatement in writing with supporting documentation

Step 8: Stay Compliant Going Forward

Whatever resolution you reach, you must stay compliant with all future tax obligations. If you miss future tax payments or filings, your resolution can be defaulted and collection can resume immediately.

Real Client Story: From Closed Business to Fresh Start

[Details changed to protect client confidentiality]

The Situation: Mike owned a small marketing agency structured as an S-Corp. When his largest client didn't renew their contract, he couldn't sustain the business. He laid off his two employees and closed the company.

Six months later, he received an IRS notice: $47,000 in unpaid payroll taxes.

Mike had paid his employees during the final months but couldn't afford to pay over the withheld taxes. He'd hoped to catch up once he closed the business and got a new job, but the penalties and interest made that impossible.

Then she received a second notice: IRS Form 2751, proposing to assess the Trust Fund Recovery Penalty against her personally for $31,000 (the employee withholding portion of the unpaid payroll taxes).

He was terrified. He had a new job earning $65,000 annually. She owned a home with equity. The IRS could take everything.

The Solution:

We helped Mike understand that He couldn't avoid the TFRP because she was clearly a responsible party (sole owner and officer of the S-Corp). However, we could negotiate how she paid it.

We filed a response to the TFRP proposal, providing financial information and requesting an installment agreement. We also requested penalty abatement for the failure-to-pay penalties on the grounds of reasonable cause (business failure, loss of major client, good faith effort to pay employees).

The Outcome:

The IRS approved the penalty abatement, reducing the debt from $47,000 to $38,000. They accepted an installment agreement of $550/month, which Sarah could afford with her new salary.

Within 18 months, Sarah received an inheritance and paid off the remaining balance. She's now completely free of the closed business tax debt.

The key was acting quickly when she received the TFRP notice and having professional representation to negotiate the best outcome.

What NOT to Do When You Owe Closed Business Tax Debt

Before we wrap up, let's cover some common mistakes that make closed business tax debt situations worse:

Don't Ignore IRS Notices

Every notice has a deadline. Missing deadlines can trigger liens, levies, or loss of appeal rights. Even if you can't pay, respond to the notice.

Don't Assume the Debt Will Go Away

The 10-year collection statute seems long, but the IRS is patient and aggressive. Don't count on the debt expiring unless you have a specific strategy.

Don't Transfer Assets to Avoid Collection

Transferring assets to family members or hiding assets is fraudulent and can result in criminal charges. It also doesn't work—the IRS can reverse fraudulent transfers.

Don't Drain Retirement Accounts Without Considering All Options

Liquidating retirement accounts to pay tax debt triggers taxes and penalties on the withdrawal. Before taking this drastic step, explore other options like Offers in Compromise or installment agreements.

Don't Try to Handle TFRP Assessments Without Professional Help

Trust Fund Recovery Penalties are complex and serious. The IRS is unforgiving on payroll tax debt. This is not a DIY situation.

Don't Start a New Business Without Resolving the Old Debt

If you owe closed business tax debt and start a new business, the IRS can levy the new business's assets or income. Resolve the old debt before launching something new.

When to Get Professional Help

You can handle some closed business tax debt situations on your own, particularly if:

- The debt is relatively small (under $10,000)

- You can pay it off within a year

- The situation is straightforward (no TFRP, clear personal liability)

But you should absolutely get professional help if:

- You're facing Trust Fund Recovery Penalty assessments

- The debt exceeds $25,000

- You need to negotiate an Offer in Compromise

- The IRS has taken aggressive collection action (levies, liens)

- You're unsure whether you're personally liable

- You're considering bankruptcy

- The debt involves multiple tax years or complex business structures

Professional representation typically costs less than the penalties and interest you'll accumulate by handling it incorrectly. And professionals know how to negotiate with the IRS in ways that maximize your outcome.

The Bottom Line: Closed Business Tax Debt Is Real, But It's Manageable

Closing your business was hard enough. Discovering that the tax debt survived the closure adds insult to injury.

But here's what you need to remember: this is a solvable problem. Thousands of former business owners have successfully resolved closed business tax debt and moved forward with their lives.

The key is understanding your liability, knowing your options, and taking action before the IRS takes action against you.

The debt won't go away on its own. The penalties and interest won't stop accruing. The IRS won't forget about you.

But with the right strategy and the right help, you can resolve this debt and get the fresh start you deserve.

Get Expert Help With Closed Business Tax Debt

At IRSProb.com, we've helped hundreds of former business owners resolve tax debt from closed businesses. We understand the complexity of TFRP assessments, personal liability questions, and the emotional toll of dealing with IRS collection actions.

Our team of experienced CPAs and tax resolution specialists will:

- Review your business structure and determine your actual liability

- Respond to TFRP proposals and negotiate on your behalf

- Explore all available options (installment agreements, OICs, penalty abatement)

- Handle all communication with the IRS so you can move forward

You don't have to face this alone. And you don't have to let closed business tax debt control your future.

Call us today for a free consultation: 214-214-3000

🔗 Visit irsprob.com

📧 Contact us online

Let's solve this together.