New 2026 HSA & HRA Limits: What Every Taxpayer Should Know

As we look ahead to 2026, the IRS has released new inflation-adjusted figures for Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), as outlined in Revenue Procedure 2025-19. These updated limits affect how much you can contribute to your HSA or receive through an excepted benefit HRA next year—and they may influence your health plan decisions during open enrollment.

Here’s a breakdown of what’s changing and how it might impact you:

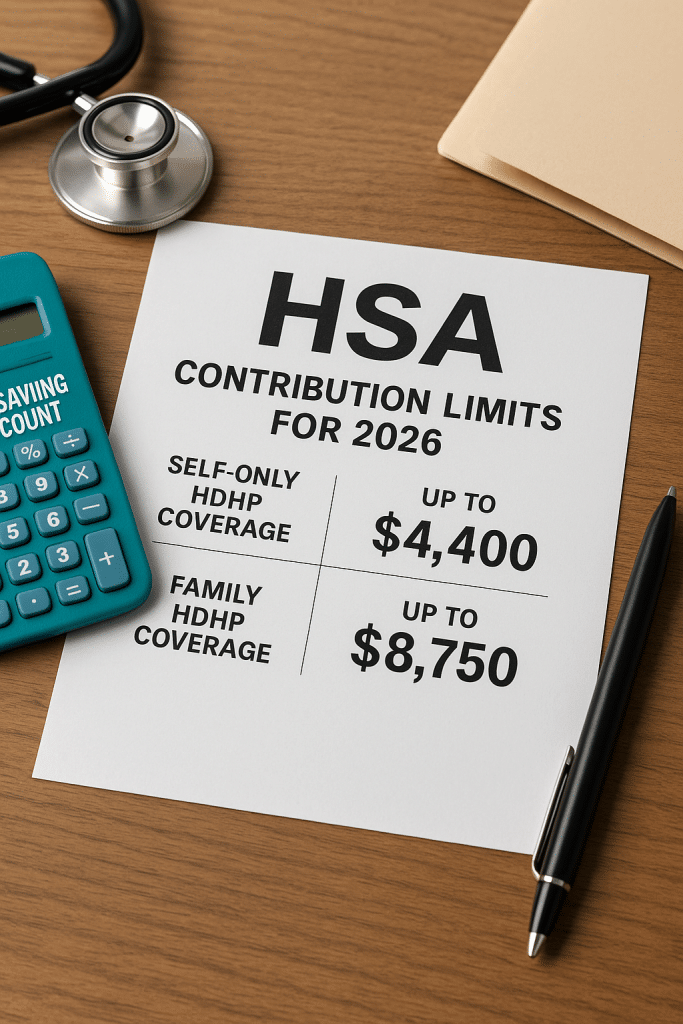

HSA Contribution Limits for 2026

Health Savings Accounts (HSAs) remain a powerful tool for individuals and families with high-deductible health plans (HDHPs). Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

For calendar year 2026, the IRS has increased the annual contribution limits:

- Self-only HDHP coverage: Up to $4,400

- Family HDHP coverage: Up to $8,750

These adjustments represent a modest increase from 2025 limits, reflecting the IRS’s response to inflation. These contribution limits include both employer and employee contributions combined.

What Qualifies as a High Deductible Health Plan (HDHP) in 2026?

To qualify for an HSA, your health plan must meet the IRS definition of a high-deductible health plan. For 2026, the requirements are:

- Minimum Deductible:

- $1,700 for self-only coverage

- $3,400 for family coverage

- Maximum Out-of-Pocket Expenses:

- $8,500 for self-only coverage

- $17,000 for family coverage

Out-of-pocket expenses include deductibles, co-pays, and other covered services costs—but not premiums.

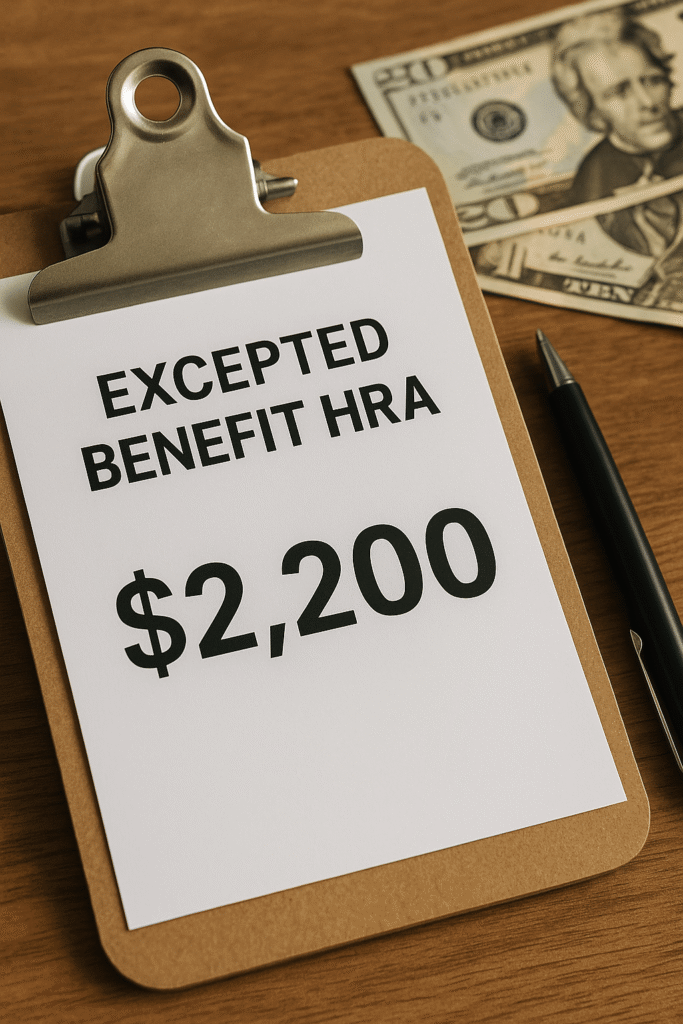

In addition to HSAs, the IRS has also updated the maximum amount for excepted benefit HRAs—a type of employer-funded plan that can reimburse employees for certain out-of-pocket health expenses.

For plan years beginning in 2026, employers may newly make available up to:

- $2,200 per employee

This amount represents the upper limit that employers can offer annually under an excepted benefit HRA, which typically supplements other health coverage and cannot be used for major medical expenses.

These changes are effective for:

- HSAs: Calendar year 2026

- Excepted Benefit HRAs: Plan years beginning in 2026

Now is a great time to review your current healthcare plans and assess how these updated figures might affect your contributions, reimbursements, and tax savings next year.

The IRS has designated the following contacts for more technical guidance:

- HSA and HRA provisions: Christopher Dellana — (202) 317-5500

- Inflation adjustment calculations: Michael Finn — (202) 317-4718

Whether you’re an individual managing your healthcare savings or an HR professional overseeing employee benefits, these updated 2026 limits are crucial for planning and maximizing savings. Be sure to incorporate them into your budgeting and benefits planning strategies.

Stay ahead of your health and your finances by staying informed.