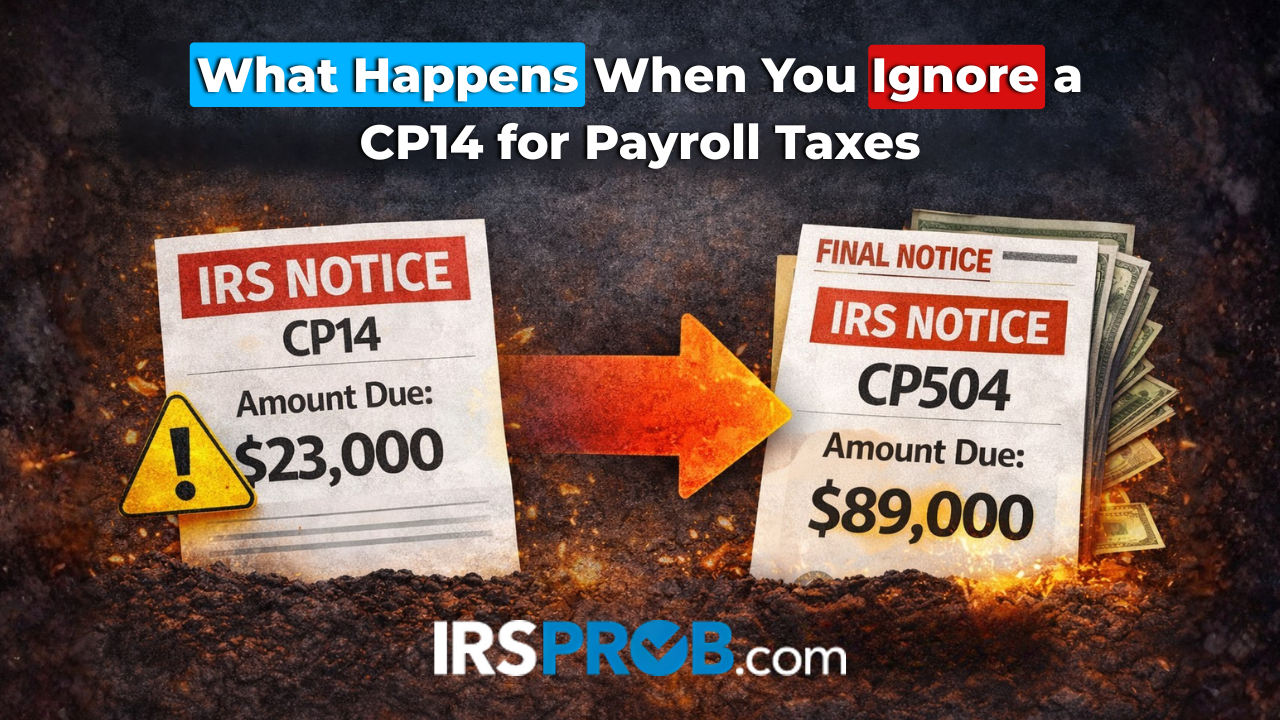

You opened the envelope three weeks ago. CP14 Notice. $23,000 in unpaid payroll taxes.

You meant to call someone. You were going to set up payments. But payroll hit, then rent, then the equipment broke. The notice got buried, and you told yourself you'd handle it next week.

Six months later, that $23,000 is now $89,000. Your bank account is frozen. A Revenue Officer is demanding personal financial statements. And the IRS is coming after you personally for the Trust Fund Recovery Penalty.

This is the documented timeline of what happens when you ignore a CP14 for payroll taxes. Every number. Every notice. Every escalation step.

And the exact points where you could have stopped it.

Month 1: What Happens When You Ignore a CP14 for Payroll Taxes: The CP14 Arrives — Original Balance: $23,000

The CP14 is the IRS opening move. No threats yet. Just notification that you owe unpaid payroll taxes from Form 941 quarterly filings.

Your $23,000 breaks down like this:

- Original payroll tax debt: $18,500

- Failure to pay penalty (0.5% per month): $925

- Failure to deposit penalty (2-15%): $2,775

- Interest (around 8% annually): $800

The critical mistake: Treating this like another bill you can pay later. Payroll taxes are different. You withheld money from employee paychecks that legally belongs to the government. The IRS calls these "trust fund taxes" and enforcement is swift and brutal.

What you should do immediately:

- Call the IRS or a tax professional within 7 days

- Request an installment agreement if you can't pay in full

- File any missing 941 returns

- Stop the penalty clock before it accelerates

What happens if you ignore it: Interest compounds daily. Penalties increase. The IRS prepares the next notice.

Balance after Month 1: $23,850

Month 2: The CP501 Reminder Notice — Balance: $24,750

You didn't respond. The IRS sends a CP501 reminder with stronger language about enforcement actions.

New charges:

- Additional failure to pay penalty: $450

- Additional interest: $450

This is your last "soft" warning. You have maybe 30 days before serious collection activity begins.

Balance after Month 2: $24,750

Month 3: The CP503 Final Notice — Balance: $26,500

This is the "Intent to Levy" notice. The IRS is done asking nicely.

The CP503 explicitly warns that the IRS will seize your assets and garnish your wages within 30 days if you don't respond.

New charges:

- Additional penalties and interest: $1,750

The lien threat is real: The IRS can file a Notice of Federal Tax Lien, which destroys your business credit, appears on background checks, attaches to all property, and becomes public record.

What you should do urgently:

- Request a Collection Due Process hearing

- Set up an immediate payment plan

- Consider Currently Not Collectible status if facing genuine hardship

Balance after Month 3: $26,500

Month 4: Revenue Officer Assignment — Balance: $38,000

The automated system failed. Now a human enforcement agent is assigned to your case.

Revenue Officers can show up unannounced, demand financial disclosure, levy bank accounts, seize business equipment, garnish wages, and initiate Trust Fund Recovery Penalty investigations.

Why the balance jumped $11,500:

- Accumulated penalties: $4,800

- Accumulated interest: $2,200

- Trust Fund Recovery Penalty assessment begins: $4,500

The Trust Fund Recovery Penalty is the nuclear option: The IRS can hold you personally liable for the employee withholding portion of payroll taxes (60-70% of total debt). This makes you personally responsible even if your business closes.

Balance after Month 4: $38,000

Month 5: Bank Levy Issued — Balance: $56,000

You ignored the Revenue Officer. The IRS issued a bank levy.

Monday morning, your business checking account had $18,000. By Monday afternoon, it's frozen. The IRS holds all funds for 21 days, then takes everything.

The cascading disaster:

- Payroll checks bounce

- Vendor payments fail

- Rent check rejected

- Employee morale destroyed

New charges:

- Trust Fund Recovery Penalty fully assessed: $12,000

- Additional penalties: $3,500

- Interest compounding: $2,500

The Trust Fund Recovery Penalty is now personal. This debt follows you even if your business closes. Bankruptcy won't discharge it.

Balance after Month 5: $56,000

Month 6: Wage Garnishment and Asset Seizure — Balance: $89,000

Maximum enforcement begins. Continuous wage garnishment takes most of your paycheck. Seizure notices sent for business equipment, vehicles, and inventory. Federal tax lien filed publicly.

Final balance breakdown:

- Original debt: $23,000

- Penalties (failure to pay, deposit, accuracy): $31,000

- Interest compounded over 6 months: $11,000

- Trust Fund Recovery Penalty (personal): $18,000

- Collection fees: $6,000

Total: $89,000

The business is likely unsalvageable. But the personal liability remains. The Trust Fund Recovery Penalty follows you. The IRS will garnish future wages, levy personal accounts, and seize personal property.

The Math: How $23,000 Became $89,000

| Month | Event | Penalties | Interest | TFRP | Total |

|---|---|---|---|---|---|

| 1 | CP14 | $3,700 | $800 | $0 | $23,850 |

| 2 | CP501 | $450 | $450 | $0 | $24,750 |

| 3 | CP503 | $900 | $850 | $0 | $26,500 |

| 4 | Revenue Officer | $4,800 | $2,200 | $4,500 | $38,000 |

| 5 | Bank Levy | $3,500 | $2,500 | $12,000 | $56,000 |

| 6 | Wage Garnishment | $13,000 | $2,000 | $18,000 | $89,000 |

The 5 Critical Mistakes That Caused This Disaster

Mistake #1: Treating Payroll Taxes Like Regular Debt

Payroll taxes aren't your money. You withheld it from employees. The IRS views non-payment as theft.

Mistake #2: Ignoring the First Notice

The CP14 is your best chance at a favorable resolution. Once you hit Revenue Officer involvement, your leverage evaporates.

Mistake #3: Not Responding to the Revenue Officer

When they contact you, they're giving you a chance before enforcement. Ignoring them guarantees levies.

Mistake #4: Not Understanding Trust Fund Recovery Penalty

Most business owners don't realize they can be held personally liable. By the time they learn about TFRP, it's too late.

Mistake #5: Waiting Until Crisis

Tax resolution firms can stop enforcement and negotiate settlements. But they need time. Calling when your account is frozen limits options.

Your Best Resolution Options

Installment Agreement: Monthly payments over 6-72 months. Stops collection actions if set up early.

Offer in Compromise: Settle for less if you genuinely cannot pay the full amount based on income, expenses, and assets.

Currently Not Collectible Status: Temporarily halt collection during genuine financial hardship. Doesn't eliminate debt but stops enforcement.

Penalty Abatement: First-time penalty abatement can remove 20-40% of penalties if you have clean history and reasonable cause.

Get Help Before the CP14 Becomes a Crisis

At IRSProb.com, we've helped hundreds of business owners resolve payroll tax debt before it destroys their businesses and personal finances.

We specialize in:

- Stopping IRS levies and garnishments

- Negotiating Offers in Compromise

- Setting up affordable payment plans

- Challenging Trust Fund Recovery Penalties

- Representing you with Revenue Officers

📞 Call 214-214-3000 for a free consultation

Don't wait until the CP14 becomes a CP503. Don't wait until a Revenue Officer shows up. Don't wait until your bank account is frozen.

The sooner you act, the more options you have.

🔗 Visit irsprob.com

📧 Schedule your consultation

Stop the escalation. Protect your business. Protect yourself.