$13 Million in Crypto Gains, $0 in Taxes: How That Ended in Court

The digital gold rush is well underway. From Bitcoin millionaires to NFT art dealers, new wealth is being minted faster than ever. But as one taxpayer just learned the hard way: digital wealth doesn’t mean invisible wealth—at least not to the IRS.

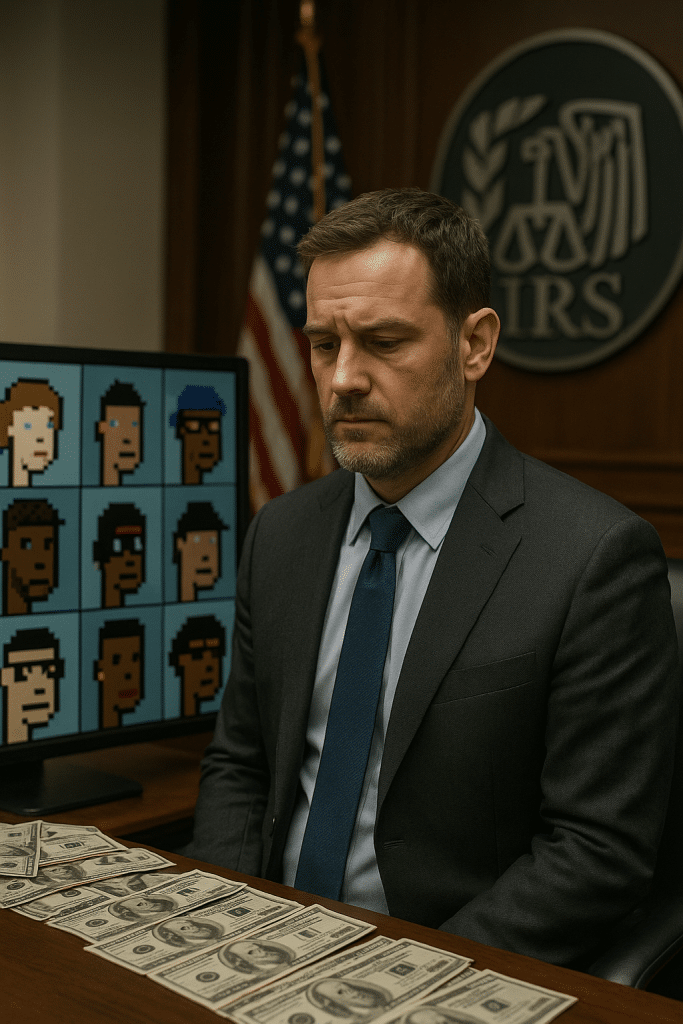

In one of the most striking examples of crypto enforcement this year, Waylon Wilcox became a cautionary tale for every digital investor who thinks taxes don’t apply to the blockchain.

In 2021, Wilcox sold 62 CryptoPunks, part of a well-known collection of pixelated NFT portraits. His sales totaled over $7.4 million.

The next year, he cashed in 35 more, earning $4.9 million.

Yet, when it came time to file his taxes, Wilcox made a costly decision:

He failed to report $13.1 million in income over two years, avoiding over $3.2 million in taxes.

The IRS wasn’t amused. He now faces criminal charges, including:

- Filing false tax returns

- Underreporting income

- A likely prison sentence

- Mandatory restitution

Bottom line: The IRS tracked the money—and so can they with your crypto activity.

What the IRS Says About NFTs and Crypto Taxation

Many people wrongly assume that digital assets are exempt from traditional tax laws. That’s not just wrong—it’s dangerous.

Here’s how the IRS views NFT and crypto transactions:

Taxable Events Include:

- Selling NFTs or crypto for USD (or any fiat currency)

- Trading one NFT for another

- Using crypto to buy goods/services

- Receiving crypto or NFTs as compensation

Non-Taxable Events Include:

- Buying and holding (no sale or conversion)

- Transferring between your own wallets (with no gain)

Tax rules require reporting capital gains and income from these activities. Whether short-term or long-term gains, they are subject to federal income tax—and in some states, additional tax.

How the IRS Tracks You on Blockchain

Think you’re safe because crypto is anonymous? Think again.

Today, the IRS uses advanced data analysis tools, blockchain analytics, and cooperation with major exchanges like Coinbase, Binance, and Kraken to match wallet activity with real identities.

They’ve also:

- Issued John Doe summonses to obtain user data

- Required 1099 forms from crypto platforms

- Expanded their Criminal Investigation Division with a dedicated Cyber Crimes Unit

If you’ve transacted in crypto, you’ve left a trail—and the IRS is following it.

What to Do If You’re Behind or at Risk

If you’re sitting on unreported gains from NFTs, crypto, staking, or DeFi, it’s not too late—but you need to act fast.

Here’s what you should do:

Stop avoiding the issue. Every year that passes makes it worse.

Gather your records—wallet logs, exchange statements, blockchain transactions.

Talk to a tax resolution expert who understands digital asset taxation and IRS procedure.

Consider voluntary disclosure or amended returns before enforcement actions begin.

IRSProb.com Insight: Crypto Isn’t Casual—It’s a Legal Obligation

At IRSProb.com, we’ve helped clients facing everything from audit threats and penalties to full-blown criminal investigations.

We understand the intersection of crypto, compliance, and crisis.

We know how to negotiate Offers in Compromise, settle back taxes, and stop aggressive IRS collection tactics.

And most importantly, we know how to protect your rights when it feels like the IRS is breathing down your digital neck.