[vc_row][vc_column][vc_column_text]

NOT RECEIVE A STIMULUS PAYMENT? YOU MAY BE OWED A TAX CREDIT

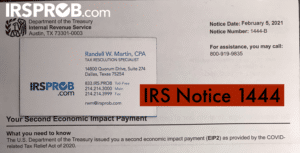

It’s important to bring your tax preparer a copy of any IRS Notice 1444 that you may have received. The IRS Notice 1444-A was for the first stimulus payment, and IRS Notice 1444-B is for the second stimulus payment.

More importantly, let you tax preparer know if you did not receive the stimulus payment. If you should have received the economic stimulus payment but did not, it should come to you as a credit on your 2020 tax return filing. At IRSProb.com, we can pull the IRS records if your IRS Notice 1444 – Economic Impact Payments has been misplaced, or if you never received the payment at all.

If we can help you get your economic stimulus payment as a credit on your 2020 tax return, call us at (214) 214-3000.

[/vc_column_text][/vc_column][/vc_row]