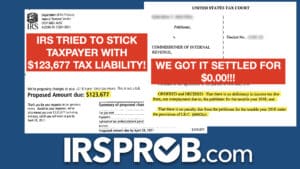

The IRS sent S.M. a certified mail notice claiming that she owed $123,677.

She was in panic and didn’t know what to do. S.M. had just lost her husband a few months before, and he had always taken care of the taxes for her. Now along with the suffering from losing her life partner the IRS wanted to take a chunk out of her as well.

She along with her CPA tried to work with the IRS to explain the series of events that led to this point. Unfortunately however, their evidence and the argument fell on deaf ears. The IRS was not responding to their numerous pleas for help.

Finally, S.M.’s CPA recommended that she contact us for a free evaluation. He explained to her that while he works on a daily basis with taxes and helping people plan how to minimize their taxes, he did not have the experience necessary to take on the IRS

Her voice cracked on our initial phone call. Fighting back the tears, she explained to me the situation. I could feel the flood of emotion coming over the phone line. S.M. and her husband had spent their lives saving up resources so that they could be independent in their later years, and she was not going to let go without a fight. She told me about some of the hardships that her and her husband had endured, and she new that he would have wanted her to not back down.

Once S.M. we had to go to work immediately. There was a deadline on the certified mail notice, and we had to get on it ASAP so as not to miss the opportunity.

We got the IRS to stand-down and drop the entire tax liability. From beginning to end the whole process took 15 months and hours of back and forth between us and the IRS. We use a belt-and-suspenders plan to work this case–basically we worked two resolution plans at the same time. We knew that if one didn’t work or if it stalled-out, the other one would would work. The key was to start both plans of attack at the same time and work each one as if it were the only chance we had at resolving this issue for our client.

All of the businesses and individuals that we take as client impact us in some way or another. While we can’t settle all of the cases for $0.00, we almost always come in better that what we promise initially. S.M. really left an impression on me.

Sincerely,

Randy