What’s a Notice of Federal Tax Lien? (video)

The lien really becomes an issue though when the IRS takes…

IRS Struggles to Sort Legitimate From Bogus Tax-Credit Claims

What the IRS Knows About Your Online Sales This Year

Why More People Owe the IRS Money, in Three Chart

0

+

Years of Experience

0

5-Star Google Reviews

0

%

An Incredible Success Rate

Tax Consultation

Tax consultation involves professional advice provided by experts to help individuals or businesses understand and manage their tax obligations effectively.

Learn More

Tax Preparation

Tax preparation involves the process of compiling and filing income tax returns, often with the assistance of a professional, to ensure accuracy and compliance with tax laws.

Learn More

Tax Resolution

Tax resolution encompasses the services and processes aimed at resolving tax disputes and liabilities with tax authorities, often involving negotiations, settlements, or compliance strategies.

Learn More

Innocent Spouse Relief

Presenting your case to the IRS in order to dissociate your from penalties due to your spouse’s inability to pay their taxes.

Learn More

IRS Audits

Ensuring that your rights are respected by IRS agents, and serving as your authorized representative knowledgable in tax law.

Learn More

Trust Fund Recovery Penalties

Assisting you with resolving delinquent employee income tax withholdings, associated penalties and abatement.

Learn More

Offer In Compromise

Providing professional guidance so that you can pay off your tax debt for a fraction of the original cost if you qualify.

Learn More

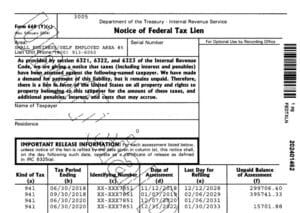

Federal Tax Liens

Guiding you through the process of negotiating a release of the lien through an installment plan with the IRS.

Learn More

Installment Agreements

Specializing in filing Installment Agreements and helping taxpayers unable to fulfill their existing IRS payment agreements.

Learn More

Federal IRS Levies

A tax levy is a legal action taken by tax authorities to seize property or assets to satisfy a tax debt when other collection efforts have failed.

Learn More

Tax Lawyer

A tax lawyer is a legal professional specializing in tax law, who advises and represents clients on complex tax issues, disputes, and compliance matters.

Learn More

IRS Tax Help

Tax help refers to assistance provided to individuals or businesses in managing and fulfilling their tax obligations, often through advisory services, filing support, or dispute resolution.

Play

Play

Play

Play

Play

Play

Play

Play

Previous

Next

CLICK HERE or call (833) IRS-PROB or (214) 214-3000 to speak to a tax associate today. They will outline the specifics of your case and help map out your options moving forward. If you’ve received any certified mail or other threatening correspondence recently, make sure and tell them so they can take the necessary steps to intervene with immediate action. Don’t wait until it’s too late! Relief is just a simple phone call or click away.

Prices will vary considerably depending on the scope of work needed to be done and complexity to your general liability issue. We have been in business for over twenty-five years, and find that it benefits the consumer to pay a fair fee for a fair service. There are simply no cutting corners. In many cases we offer interest free financing of our fee, allowing you to make payments over time. A general range for our services is as follows: simple tax returns can cost a few hundred dollars each, simple tax resolution cases can be between fifteen hundred and twenty five hundred each, and more complex cases can cost in the thousands. As fees vary based on work, such as returns needing to be filed and garnishments needing to be lifted, please contact one of our tax associates for a free evaluation of your options and to better price your tax issues.

For most cases involving a tax liability, we begin representation by having you sign and remit to us several IRS forms. The first is an 8821, which allows us to order your master tax file and see how much is owed and for what years. The second form is a 2848 which allows us to speak directly to the IRS on your behalf so that we can request a hold against collection action and negotiate directly with your assigned revenue officer. We then send you a financial questionnaire which must be filled in and sent back to us. At that point, there will be discussions as we work to prepare your resolution matter and/or negotiate directly with an assigned revenue officer. Depending on the resolution matter, cases will vary moving forward, but these are the basic steps to getting represented.

The specific steps involved in an IRS tax resolution case will vary depending on the specific circumstances of the case and the resolution options being pursued. However, generally speaking, the following steps may be involved:

The first step of getting the ball rolling and signing up with us is always the hardest. This begins with a call to us at (833) IRS-PROB or (214) 214-3000. Call Today!

IRSPROB.com is a tax resolution firm, not a law firm in the state of Texas. Since we deal with income taxes, we work at the Federal level. Our sole area of focus is on mediating and resolving difficult tax liability matters before the IRS and State taxing authorities. We are a team of dedicated tax professionals with one singular goal in mind: to get you the best tax relief results possible. That means rolling up our sleeves and tackling wage garnishments, bank levies, un-filed tax returns, settlements and calming aggressive revenue officers. We have tax preparers, certified public accountants, attorneys, and enrolled agents available to work on the cases of our clients as required by the case.

CAN I USE MY LOCAL CPA OR TAX ATTORNEY?

Yes, but ask questions. Tax mediation and collection work is a specialty niche service, and is one the requires years of experience and knowledge. While your local CPA or Attorney may have a general understanding of your liability issue, the difference between our specialties is similar to hiring a general physician to perform open heart surgery; education and experience are dramatically different.

IRS Tax issues is all our firm does, and we have become an expert in the field, consulting both individual taxpayers and corporations across the nation for the past twenty-five years. As our volume of cases is so high, we are able to offer our services at affordable rates relative to some attorneys or CPA’s who charge by the hour with limited knowledge of the Internal Revenue Code, US Treasury Regulations, Internal Revenue Manual, and other IRS procedures, letters, and announcements that change on a weekly basis.

DO YOU HAVE ATTORNEYS?

Yes, our hard working team includes attorneys, seasoned in all aspects of IRS collections and settlement proceedings. Some tax providers claim to use attorneys when they really don’t. You can verify this by requesting them to send you a 2848 power of attorney form. On this form, you will be able to see who is representing you. If the representative is not an attorney, you do not have an attorney representing you. It’s as simple as that. Besides attorneys, we also have Enrolled Agents on staff. It is our belief that different educational backgrounds bring a unique perspective to each case, and help to better service the many different areas of tax resolution for our clients. What is a ‘Tax Relief Attorney’? It’s a general term used to describe an attorney with experience in tax relief matters, such as negotiating an IRS installment agreement or preparing settlements, and does not imply that the attorney has a specialized tax law degree. Note: Due to normal staffing variances, we may or may not have both forms of representation available at all times during the year.

WHERE ARE YOU LOCATED?

We are located in Dallas, Texas and serve clients across the nation. Our mailing address is:

IRSPROB.com

14800 Quorum Drive, Suite 140

Dallas, Texas 75254

For most of our clients, we service them easily through phone, chat and email. However, we understand that some of our clients prefer meeting in person. We have beautiful facilities and meet with clients everyday. If you would like to setup a time to come in, simply call a tax associate and they will schedule an appointment.

I OWE OVER $1,000,000. CAN YOU HELP?

Yes! We are one of the only firms in the nation with years of experience in these high dollar value cases!

WHO QUALIFIES FOR A TAX RELIEF PROGRAM?

If you have a tax debt, and the IRS or state collection agencies are in the process of collecting, both individuals and businesses can qualify for certain tax relief measures. These could be a reprieve against collections wherein all notices and threats of asset seizure are suspended, an agreement to waive accrued penalties on the initial tax liability, or in certain cases a suspension of collection altogether and a mediation of the tax liability. As qualifications for these measures vary from case to case, understanding your options and getting current with an accurate road-map are important considerations our associates will sit with you and go over in depth.

WHAT IF I HAVE YEARS OF UNFILED TAX RETURNS?

You want your prior-year tax returns done the right way. We are specialist in catching taxpayers up on prior-year tax return filings while minimizing the amount owed.

Many taxpayers will accumulate tax debt at an alarming rate when their returns are not filed because the IRS submits the return for them on their behalf, commonly referred to as an SFR (Substitute for Return). This is the worst form of taxation as it allows for zero deductions and maximizes the IRS’s revenue. We assist many clients who haven’t filed their tax returns in years, and in many cases, we can reduce the liability that has accrued, bring the taxpayer legally current, and maintain their returns with our year-over-year tax planning and preparation service.

WHAT IF I HAVE YEARS OF UNFILED TAX RETURNS?

You want your prior-year tax returns done the right way. We are specialist in catching taxpayers up on prior-year tax return filings while minimizing the amount owed.

Many taxpayers will accumulate tax debt at an alarming rate when their returns are not filed because the IRS submits the return for them on their behalf, commonly referred to as an SFR (Substitute for Return). This is the worst form of taxation as it allows for zero deductions and maximizes the IRS’s revenue. We assist many clients who haven’t filed their tax returns in years, and in many cases, we can reduce the liability that has accrued, bring the taxpayer legally current, and maintain their returns with our year-over-year tax planning and preparation service.

WILL THE IRS CONTINUE COLLECTING ONCE I’M REPRESENTED?

For the most part, we are generally able to stop most forms of collections against our clients quickly. When you decide to take advantage of our services, we will assume tax power of attorney (IRS form 2848, which you can review on our forms page) which allows us to do several very important things for you. First, it gives us authority to speak to the IRS on your behalf, letting us contact the IRS and request either a 30, 60, or 90 day hold on collections, and when appropriate, we can even place an account into what’s called CNC – Currently Non Collectible, wherein the IRS will cease collection action indefinitely. The second thing the 2848 allows us to do is get your mail and notices, which keeps us current with your case and directs correspondence through our office instead of your mailbox. From here, we will work with you to tailor a program or relief option best suited to your needs.

WHAT DOES IRSPROB.COM DO?

IRSPROB.com is a full service tax consulting and mediation provider, offering a suite of solutions including individual and corporate tax return planning, IRS audit and appeals representation, garnishment and levy removal, and IRS negotiations.

The lien really becomes an issue though when the IRS takes…

Learn how IRSProb in Texas can help negotiate an Offer…

Thinking of Converting a 529 Plan to a Roth? The…

The lien really becomes an issue though when the IRS takes…

Learn how IRSProb in Texas can help negotiate an Offer…

Have a tax question?

Get Tax Expert Help Now