[vc_row][vc_column][vc_column_text]Recently, the Taxpayer Advocate Service has published tips on identifying IRS Revenue Officers (ROs) who are making unscheduled visits to taxpayers as part of a compliance push. The Tax Tip also informs taxpayers of what they should expect from revenue officers during these surprise visits.

In November 2019, the IRS announced that, as part of a special compliance effort, its ROs would begin making unannounced visits to taxpayers that have ongoing tax issues. ROs are trained IRS civil enforcement employees who are sent out to resolve compliance issues with missing returns or unpaid taxes.

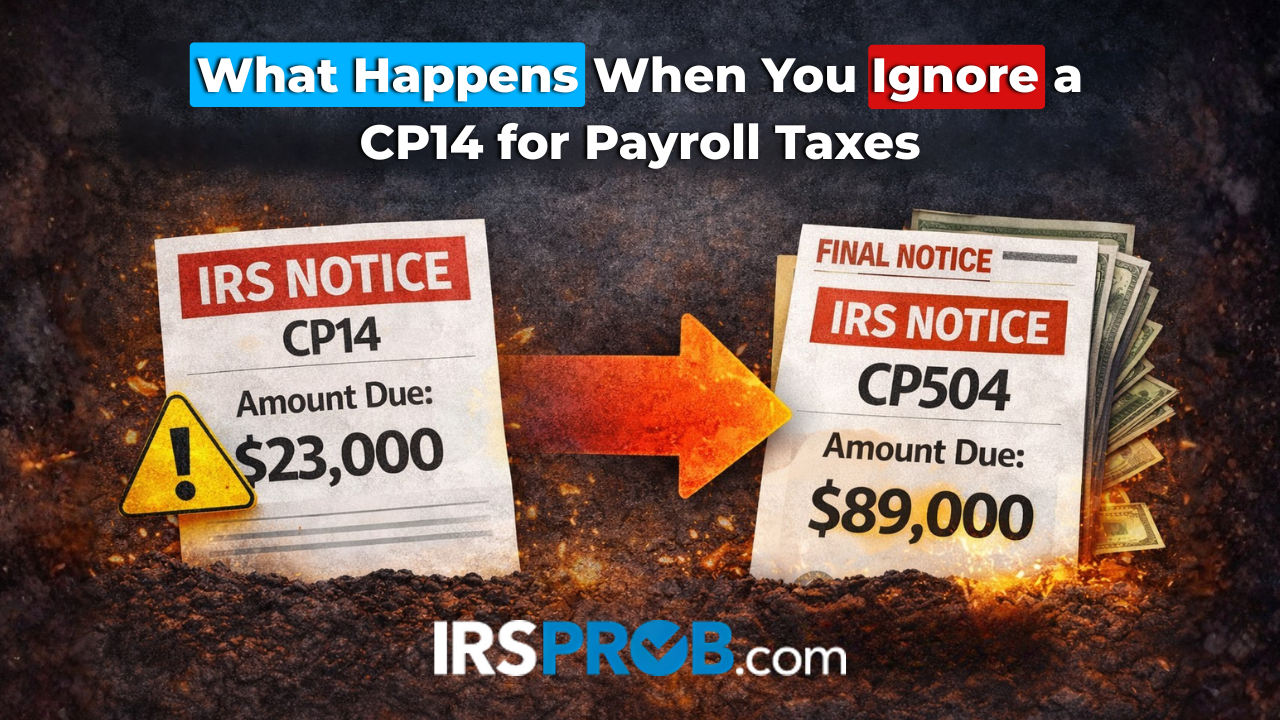

The IRS’s main goal for these unannounced visits is to contact taxpayers that have a previously known tax compliance issue, particularly a payroll tax issue, that wasn’t resolved through mail contacts. The IRS emphasized that these unannounced visits typically occur after the IRS has made numerous contacts by mail about the existing tax issue.

Here are some items taxpayers should expect from the RO during these visits:

The RO should provide two forms of official identification, a pocket commission and a HSPD-12 card. (The HSPD- 12 card is a standard government identification card for federal employees and contractors). Both forms of identification include a serial number and photo of the IRS employee. Taxpayers have the right to see both forms of identification.

Taxpayers can verify the RO’s identity by calling a dedicated IRS phone number, which the RO should provide. Taxpayers should use this phone number to verify the information on the RO’s HSPD-12 card. The RO should also provide the phone number of his or her manager if the taxpayer feels the need for it.

If the taxpayer the RO is visiting has an outstanding federal tax debt, the visiting officer will request payment. However, a legitimate RO won’t issue threats or demand unusual forms of payment, such as prepaid debit card or an iTunes card. Any payments should be made to the United States Treasury.

ROs may consider alternatives to immediate full payment of an outstanding tax debt, especially when requiring such payment would cause economic hardship. Alternatives to immediate collection available to an RO include:

- Installment agreements to allow the taxpayer to pay the bill over a certain time period.

- Determining whether the taxpayer is a good candidate for an offer in compromise (under an OIC, the IRS accepts less than the entire amount of the tax liability).

- Suspending collection due to the taxpayer’s CNC (currently not collectible) status, which could include taxpayers owing trust fund taxes; and

- Suggesting relief from late-payment penalties if there is probable cause or recommending adjustment or abatement if there is doubt as to liability or collectability of the tax debt.

ROs should inform the taxpayers they visit about the Taxpayer Bill of Rights (TBOR) . The TBOR is a set of core rights taxpayers have when dealing with the IRS.

ROs have started making surprise visits to taxpayers under this new compliance push in Wisconsin, Texas, and Arkansas. The IRS is expected to announce general information about the locations of more surprise visits when they begin.

[/vc_column_text][us_image image=”1103″][/vc_column][/vc_row]