The High Cost of Overlooking 1099 Filings: A Warning for Businesses

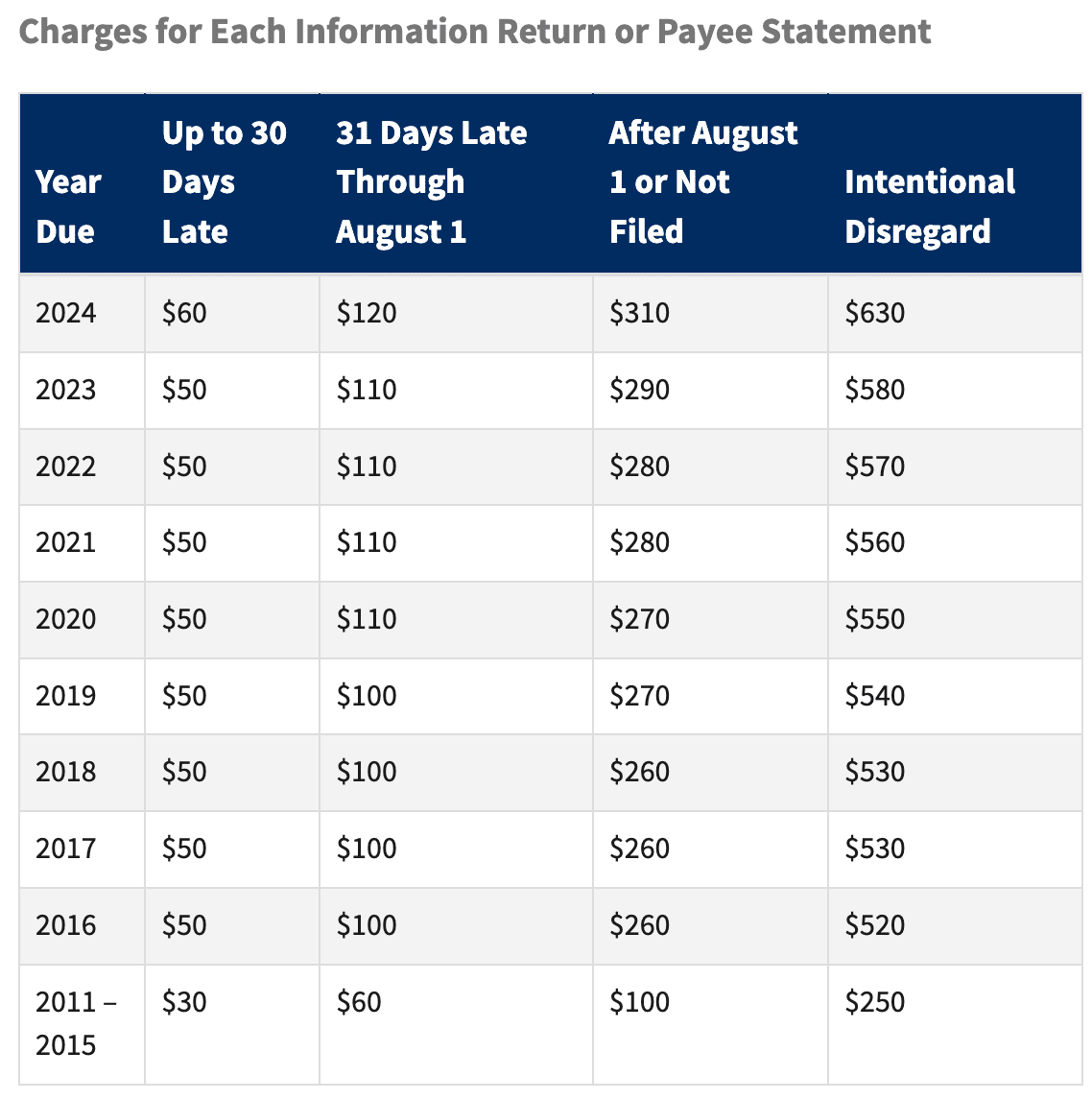

In the complex web of business operations, the task of filing 1099 forms can sometimes fall through the cracks. However, overlooking this critical requirement is not just a minor slip; it can lead to substantial penalties that escalate quickly, as demonstrated in the attached illustration. It’s crucial for businesses to understand the importance of timely 1099 filings and the financial risks associated with delays or omissions.

What Are 1099 Forms?

1099 forms are a series of IRS tax forms used to report various types of income other than wages, salaries, and tips (which are reported on W-2 forms). For businesses, this includes payments made to independent contractors, interest and dividends, and other financial transactions. Filing these forms is a crucial part of compliance with federal tax laws.

The Penalties for Not Filing

As the provided chart starkly indicates, the penalties for not filing 1099s can be severe. For the tax year 2024, if you file a 1099 up to 30 days late, the penalty is $60 per form. If you delay beyond 30 days but file by August 1, the penalty doubles to $120. Should you miss that deadline, the penalty jumps to $310. But what should capture your utmost attention is the penalty for “Intentional Disregard.” If the IRS deems that you have willfully neglected to file, the penalty soars to $630 per form – a cost that can quickly become financially crippling if multiple forms are involved.

Better Late Than Never

If you’ve missed the deadline, it’s imperative to file as soon as possible. Each day delayed is a step closer to heftier fines. The penalties for late filing increase as time goes on, but they pale in comparison to those for intentional disregard. Late filing demonstrates to the IRS that your business is making an effort to comply, which can be favorable if you’re seeking abatement of penalties for reasonable cause.

The Bottom Line

The penalties reflected in the illustration are not mere scare tactics; they are real figures that can have a tangible impact on your business’s financial health. By ensuring that your 1099s are filed on time, you safeguard your business from unnecessary financial strain. Remember, the IRS is not just a tax collector; it’s a tax law enforcer. Failing to file 1099s can be seen as an evasion of that law.

If you’re struggling to keep up with the demands of 1099 filings, consider consulting with a certified public accountant or an enrolled agent. These professionals can offer expert guidance, ensure compliance, and even help you navigate the penalty abatement process if necessary.

In conclusion, take the time to review your records, ensure all necessary 1099s are filed, and stay ahead of deadlines. Your business’s financial health and peace of mind are worth that diligence.

Stay informed, stay compliant, and steer clear of penalties.